Systematically Trading Crypto 0DTE Options: Playing With Fire

Over the past several months there has been a noticeable rise in the volume of 0DTE options being traded in traditional financial markets. As indicated in the name, “zero-day to expiry” (0DTE) options mature on the same day and are commonly used by traders to gain leveraged market exposure while paying a low premium. Although the premiums for these options are low in dollar terms, the theta decay associated with 0DTEs is extremely rapid to the detriment of buyers. According to Goldman, in SPX option markets these 0DTEs made up over 40% of trading volumes in Q4 2022 as shown below.

JPM also conducted a comprehensive study on this phenomena and concluded that the rise in 0DTEs can largely be attributed to HFT and algorithmic traders seeking to monetize intraday price-action using levered instruments. In the same study concerns were brought up suggesting 0DTEs can materially impact market stability due to the sheer notional volume of these leveraged short-dated products. Based on JPM’s quant models, even a moderate move in the market could have a cascading domino effect on the broader market as a result of market-makers hedging their gamma risk. While their concerns do have merit, there have been rebuttals from other firms such as BoA indicating these “Volmageddon 2.0” risks are overblown given the 0DTE risk is cleared during the same day. Furthermore, the short-volatility positioning in the “Volmageddon” blowup during 2018 took several years to accumulate before imploding the VIX ETN space.

Although both parties make compelling points, the goal here is to identify whether we can make money from trading crypto 0DTEs in a way that doesn’t blow up our portfolio. The JPM researchers explored trading the 0DTEs on an intraday basis and found there was some advantage to trading these products if performed on a higher frequency time horizon.

One key thing to keep in mind is that option market-makers in crypto have a much smaller impact on spot prices compared to traditional dealers such as Citadel trading markets on SPX options. Therefore, the risk of a “Volmageddon” event occurring in crypto stemming from 0DTEs let alone general systematic option selling is highly unlikely as the options market is still developing. Furthermore, the crypto options market is nowhere close to having the same liquidity and trading infrastructure compared to SPX, therefore, it’s highly unlikely any HFT or ultra-short term strategy will reap any sustainable profits in crypto until similar advancements are made.

As a result, the goal of this research piece will be to trade 0DTE crypto options on a longer time-horizon without the need for HFT infrastructure. Notably, systematically selling volatility is a common strategy employed by many traders, therefore, we’ll study different regimes to determine optimal conditions for trading this particular strategy.

Overview of Backtest Modelling:

The goal of this strategy is to systematically sell 0DTE straddles while hedging the position’s net delta on a dynamic basis.

- For each day, sell 1x ATM call and 1x ATM put option with an expiration less than or equal to 24 hours on Deribit. All positions are held straight into expiration with no early exit

- All option trades will be executed at the top of the book best bid price

- At the beginning of each trade, the net delta of the position will be hedged flat. At each hourly timestamp, if the price of the underlying changes more than a threshold of 2.50% since the last hedge, the model will then perform another delta hedge to bring the net delta back to zero

- All P&L will be coin-denominated, therefore, no conversion back into USD or adjustments of deltas will be required

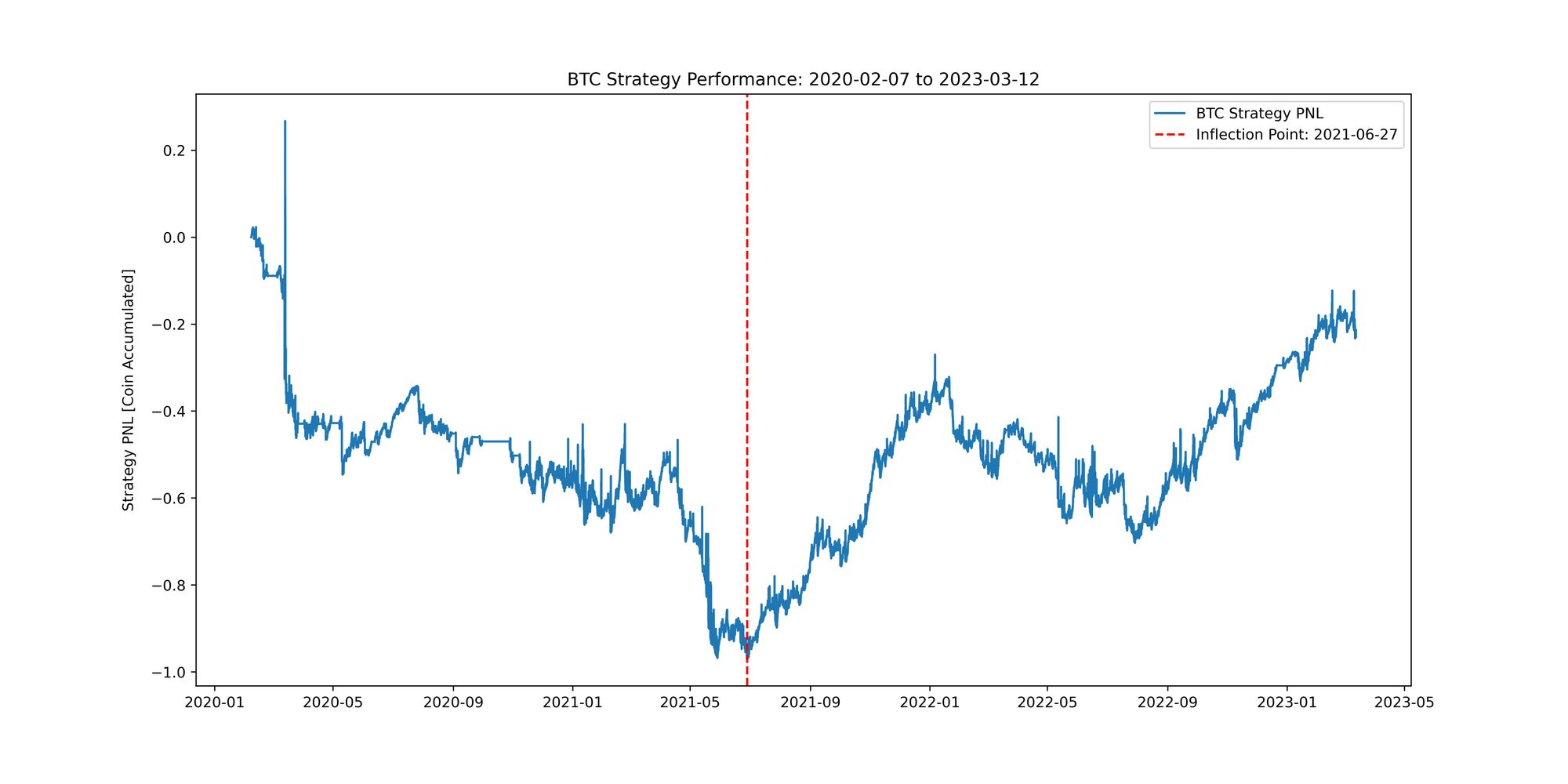

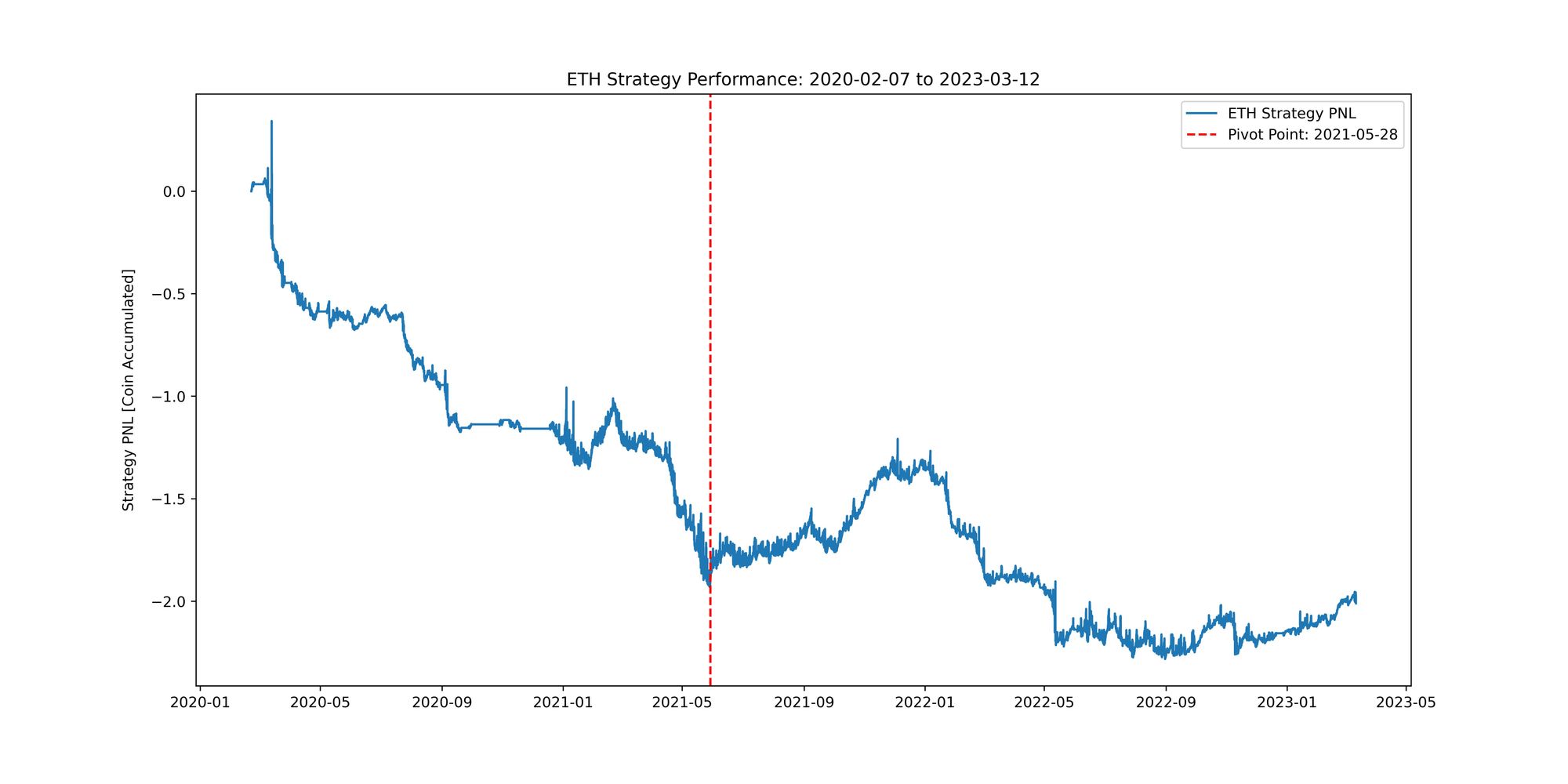

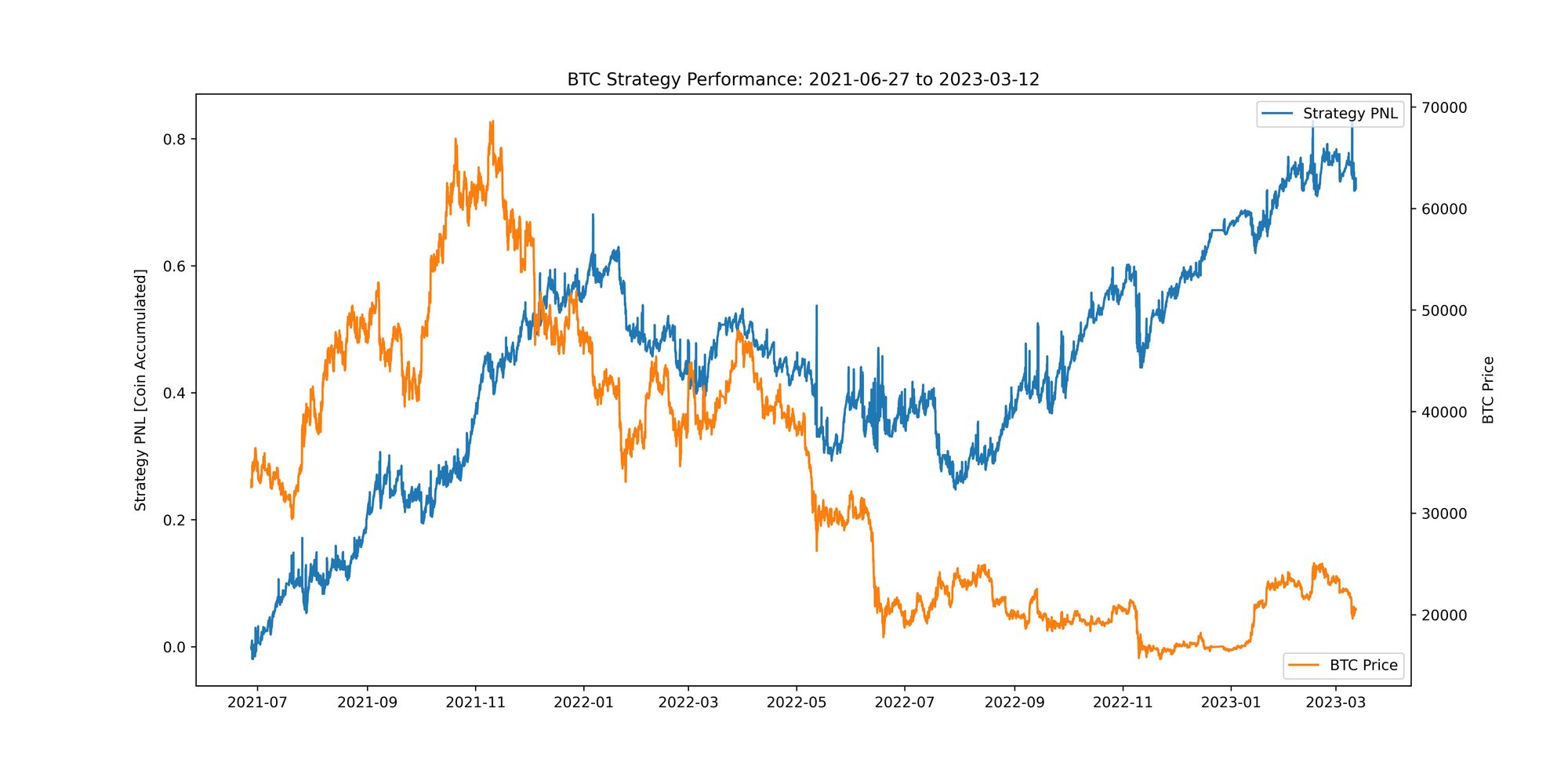

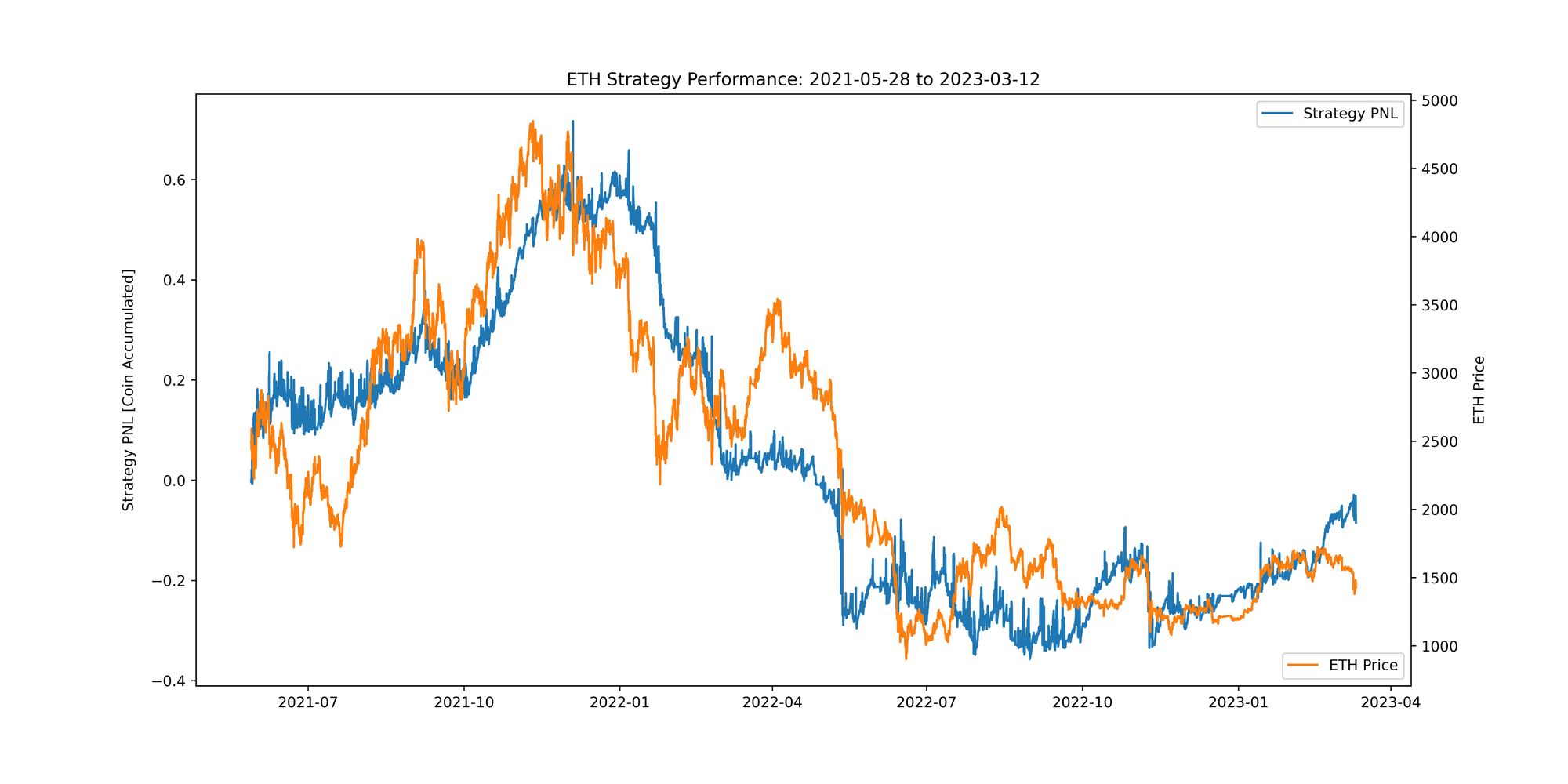

As can be seen below the cumulative P&L for both BTC and ETH is very poor. If we step back and think about the different regimes crypto has experienced over the past several years, these results should not come as a major surprise. As one of the most volatile markets in the world, it’s expected that blindly selling 0DTE straddles on such an asset will be a losing strategy in the long-run.

Things get a bit more interesting when we start to dissect the different regimes for this strategy. Although we are cherry-picking regimes based on past performance, this process can help us better understand periods when deploying this strategy makes sense. The vertical red lines on the plots above for both ETH and BTC correspond to key inflection points which were discretionarily selected to identify where the strategy experiences a pivot due to a regime change. Although these inflection points are not the exact same date for BTC and ETH, they are close enough for us to distinguish between the two different regimes.

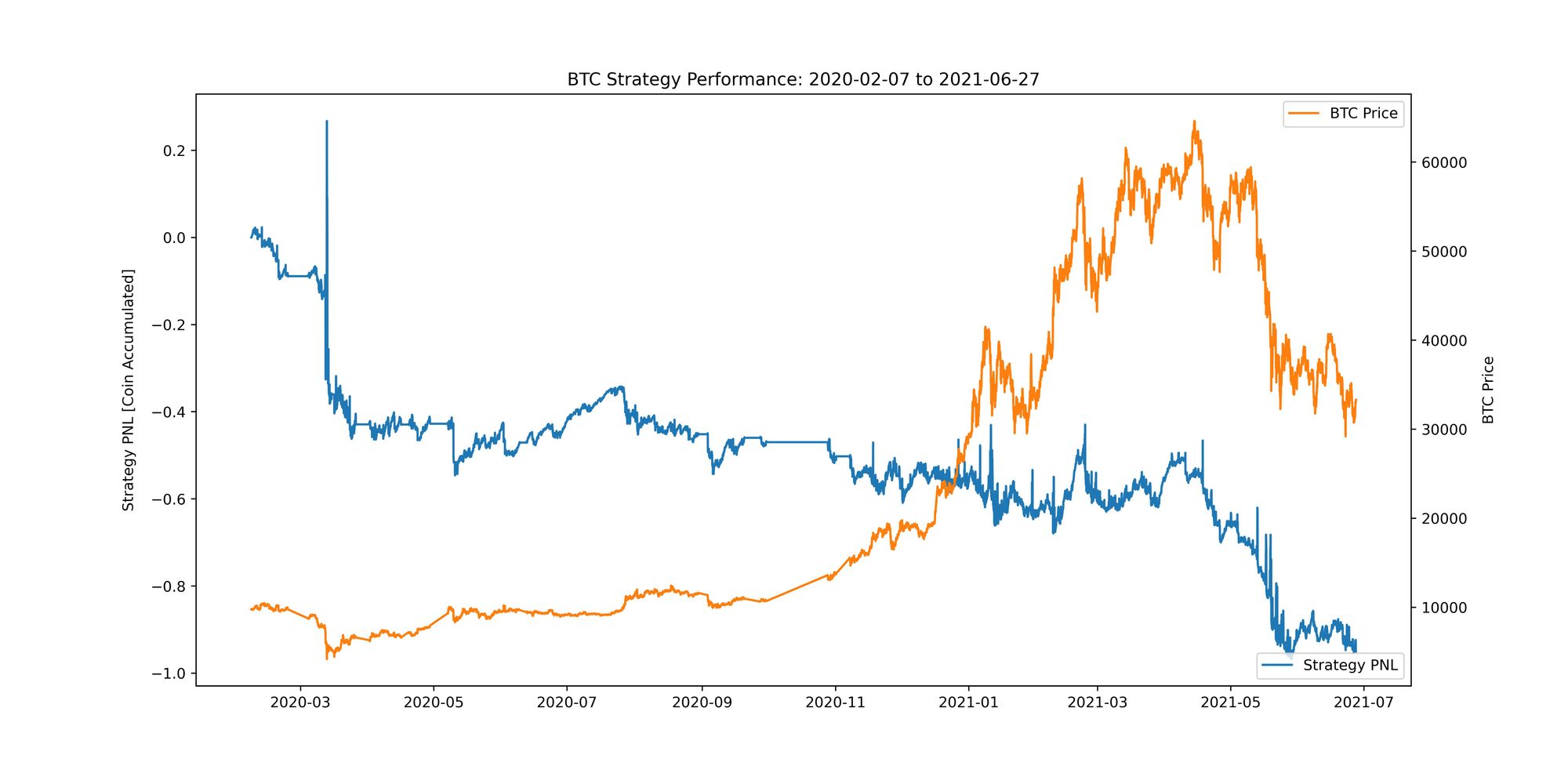

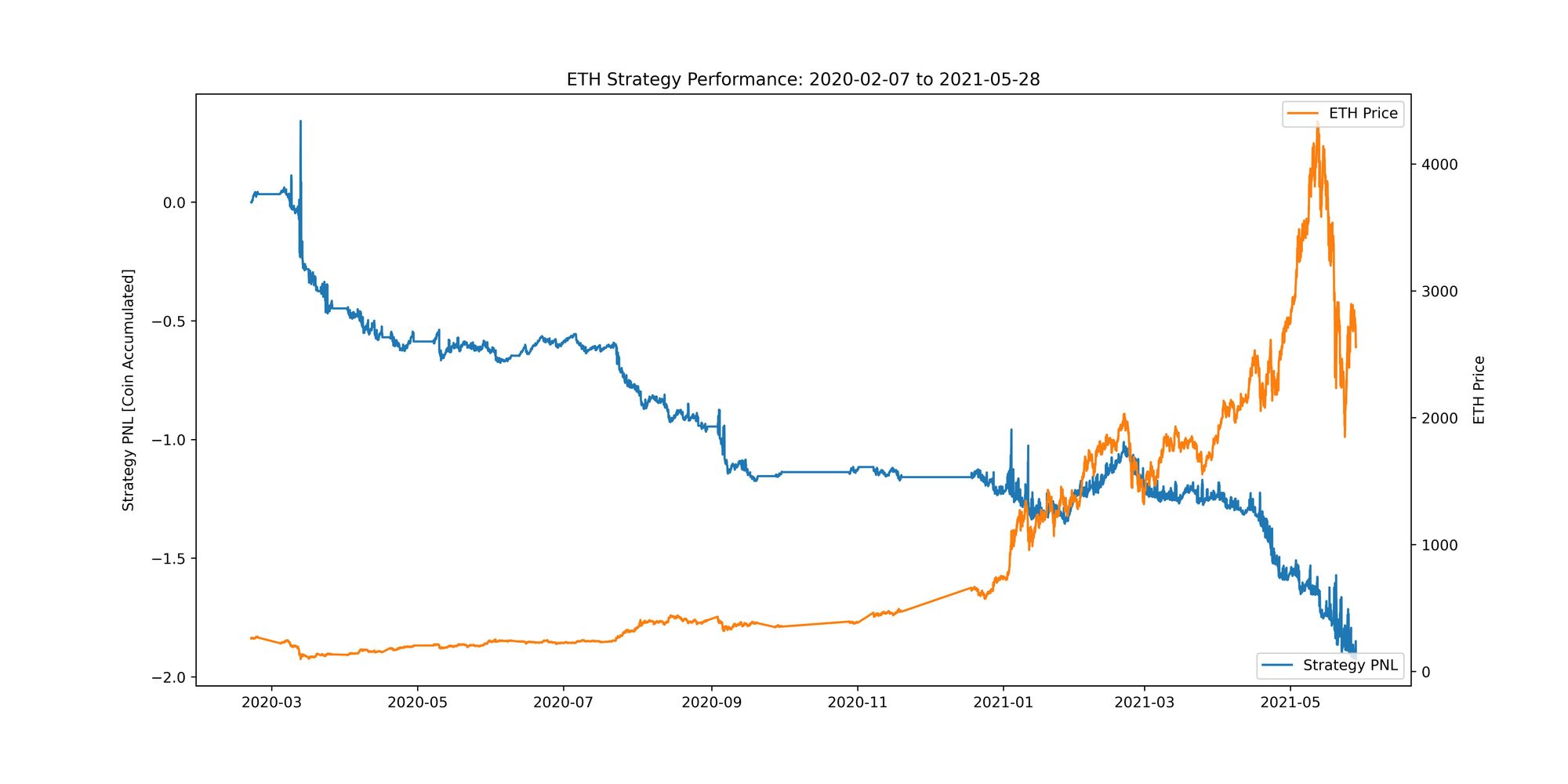

Regime #1: Bull-Run: Start of COVID to Summer of 2021

During this regime risk assets were bid up due to easy monetary conditions. Furthermore, we saw a massive flood of institutional capital piling billions of dollars into crypto which was led by Michael Saylor’s aggressive accumulation of BTC for Microstrategy’s balance sheet. Throughout this period we saw incredible volatility with massive intraday price action. Given the strategy we are running is effectively short gamma on a daily basis, the violent intraday moves during this volatile market regime would have resulted in consistent losses being accumulated over time (not to mention the risk of being exposed to infinite downside and upside losses associated with selling straddles).

Regime #2: Summer of 2021 to Today

During this second regime we experienced the final innings of the bull market and a collapse in all crypto prices. Despite all the tail events during this regime such as the 3AC fallout, UST imploding and FTX collapsing, the BTC 0DTE selling strategy surprisingly performed decently well. There were still steep drawdowns when markets were volatile around these pivotal events, however, periods of choppy price action allowed the strategy to accumulate sufficient P&L by selling these super short-dated options. Unfortunately the same cannot be said for ETH. Despite being exposed to mostly the same events and market risks, ETH’s 0DTE option market behaved completely differently from BTC and failed to generate sufficient yield from option selling during periods of choppy price action.

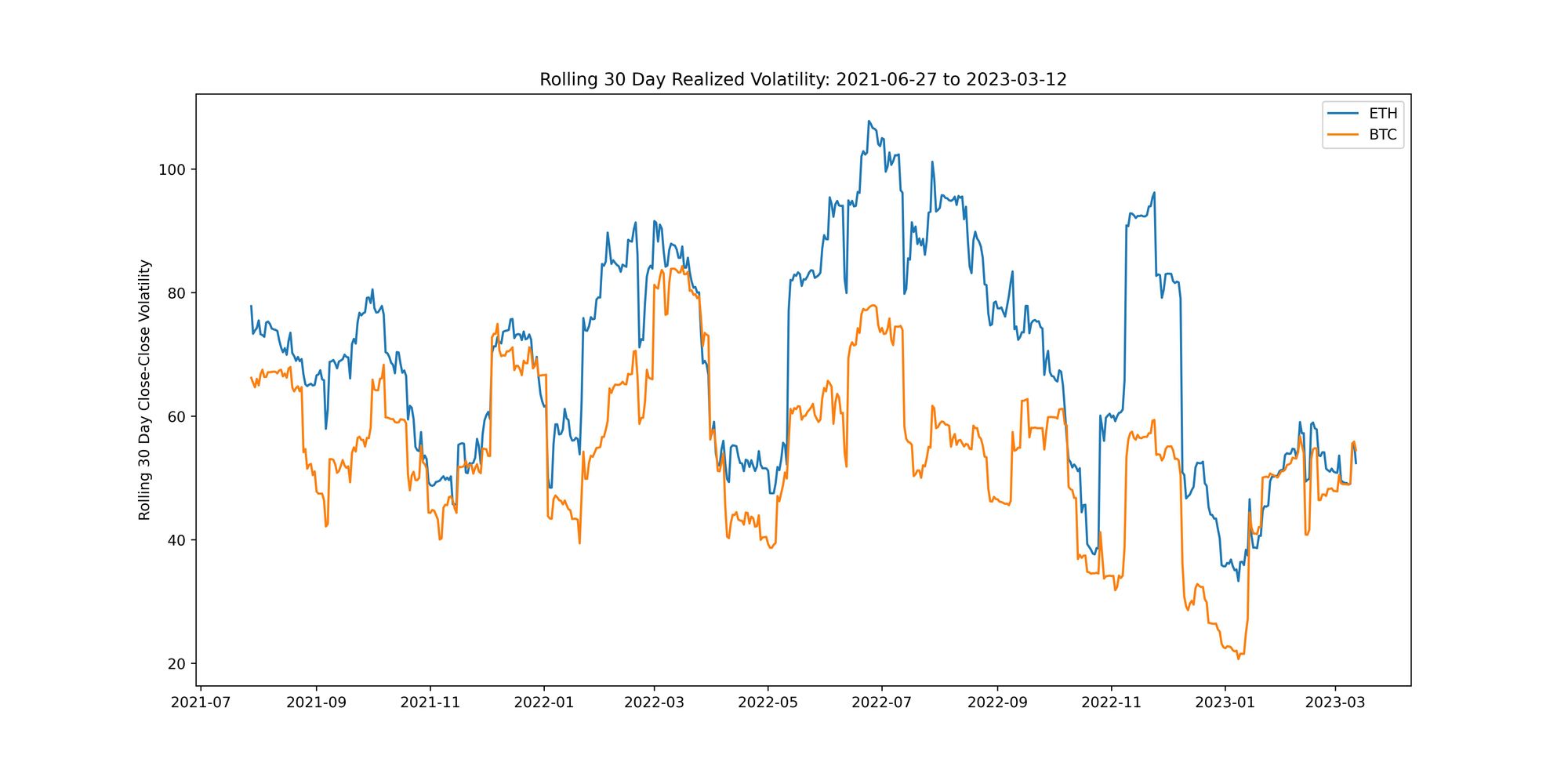

A potential reason for this stark difference in performance could be the fact that BTC was inherently less volatile than ETH during this specified time period. Specifically, on average ETH was 1.30x more volatile than BTC based on a rolling 30 day volatility metric. As such, it’s likely BTC’s lower relative volatility was the main reason the 0DTE selling strategy performed so much better during this period compared to ETH. Furthermore, it’s commonly observed that liquidity on Deribit tends to be superior for BTC options relative to ETH, therefore, executing at better bid prices for BTC may have been another contributing factor for its outperformance.

Concluding Thoughts

Overall, it’s important to note that identifying these regimes is where most of the edge lies in running a short-vol or mean-reversion strategy. There are a variety of quantitative and discretionary tools used to identify these regimes such as the Hurst exponent or other technical based indicators which could filter out non-ideal trading conditions. We observed that for both BTC and ETH, selling 0DTEs during a wild bull run associated with high volatility is very unprofitable. Conversely, for BTC specifically, the best environment to sell 0DTEs is when BTC is experiencing choppy / bearish price action as we’ve witnessed over the past several months. Furthermore, in practice traders have to acknowledge liquidity for these 0DTEs may not be ideal, therefore, using an OTC or RFQ service such as Paradigm could be one tactic to help reduce adverse slippage of this strategy.

Acknowledgements: Euan Sinclair and GravitySucks for sharing their thoughts and feedback.

Disclaimer: Nothing mentioned in this article constitutes as financial advice - opinions expressed are solely my own.