A Quantitative Analysis Of The BTC Futures ETF

After hearing many of your friends and colleagues talk about Bitcoin over the past few months you eventually cave in and decide to make a small allocation in your portfolio. Fortunately, there are now a lot of different ways to gain exposure to BTC. Of course you could buy spot BTC and store it in your personal hardware wallet, however, this process can be complicated and is not the best user experience.

At the same time there’s been a lot of buzz lately about the launch of the world’s first regulated BTC ETFs debuting in the US. If many of the pundit’s predictions are true and BTC reaches $1M in several years, then it’d be an incredible opportunity to buy one of these ETFs inside a tax-free investment account such as a TFSA or Roth IRA. Buying the ETF abstracts away a lot of the headaches and complexities involved with manually storing BTC in a hardware wallet.

Although this seems like a great choice, it’s worthwhile to take a second look at these newly issued BTC ETFs — there’s more than meets the eye and careful analysis is required to ensure investors choose the right product for their given needs.

This research piece is broken down into three parts. For those already familiar with futures please feel free to skip to part 3.

- Part 1: Differentiate between futures ETFs vs synthetic ETFs

- Part 2: Provide a brief summary on how futures contracts work

- Part 3: Model the return profile of a futures ETF vs holding actual BTC

Part 1: Physical vs. Synthetic ETFs

With over $9 trillion in global ETF assets under management, it’s an understatement to say that ETFs have been successful in main-stream adoption. Many retail and institutional investors like ETFs due to their simplicity of gaining exposure to a particular market in a passive manner. Rather than buying 500 individual stocks of the S&P 500 index, investors can simply purchase the SPY ETF to gain the same exposure. There are generally two types of ETFs which we’ll discuss below:

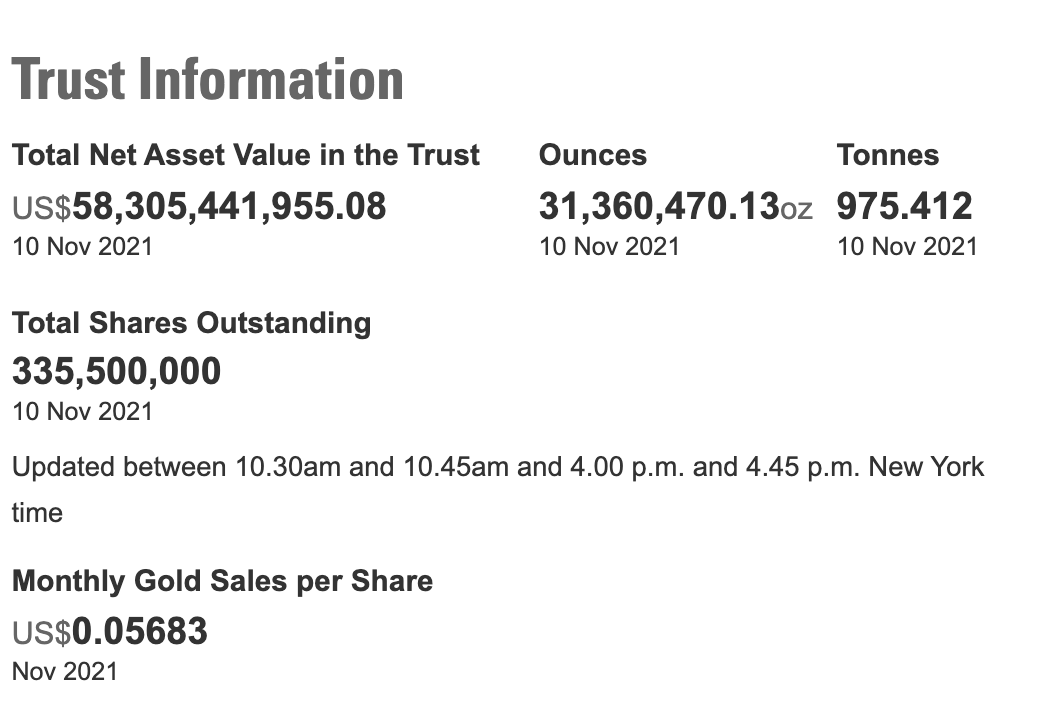

- Physical ETF: these ETFs contain the actual underlying asset. For example, GLD is the ticker for SPDR Gold Shares which provides investors with exposure to real gold stored in HSBC’s London vault. Below we can see the GLD trust holds nearly 31 million ounces of gold backing the ETF.

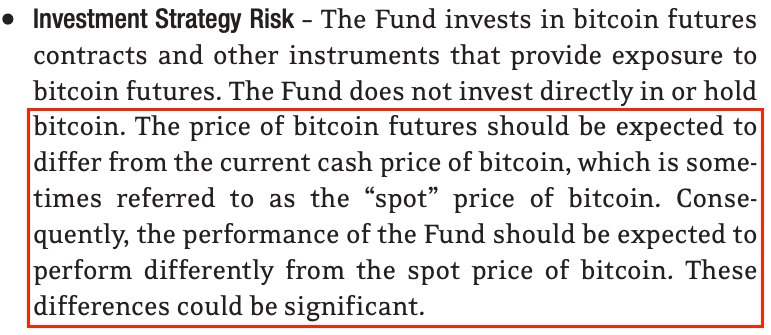

- Synthetic ETF: these ETFs don’t actually contain the underlying asset, rather investors are given exposure to the underlying through financial derivatives. These ETFs provide less sophisticated investors with exposure to more exotic markets which they would otherwise not be able to access. For example, USO is the ticker for the United States Oil ETF. As shown below, this ETF doesn’t actually hold real oil, rather, it is constructed using a portfolio of WTI Crude Oil Futures.

Given BITO was the first Bitcoin ETF to hit the market we’ll focus on this product throughout this piece. Firstly, let’s take a look at the description of BITO on the ProShares website:

Interestingly, BITO doesn’t have a single dollar’s worth of actual BTC in the ETF. Rather, BITO and all of the newly issued ETFs over the past few weeks fall under the category of synthetic ETFs where they buy CME BTC futures contracts.

Before we proceed further it’s necessary to briefly review futures contracts in order to appreciate the consequences of investing in a synthetic ETF composed of futures.

Part 2: Overview of Futures Contracts

Futures are financial instruments used by companies, financial institutions, and traders for a variety of speculative and hedging purposes over a fixed period of time. Similar to options, futures contracts derive their value from the underlying asset price and also have a predetermined maturity.

There are three important points to know about futures:

- Many people trade futures over the actual underlying asset because of the amount of leverage they can utilize. For example, an investor can open a $100k futures position with only $10k worth of initial margin. This is a much more capital efficient way for sophisticated players to trade the underlying asset.

- Traditional futures contracts have fixed maturities. This means an investor seeking continuous exposure to a particular asset must constantly purchase new futures as they expire (we refer to this as “rolling” into new contracts).

- Futures prices often differ from the actual underlying asset price. When the futures price is greater than the underlying price this is referred to as contango. Conversely, when the futures price is less than the underlying price this is referred to as backwardation. Most importantly, when a futures contract expires its price will be the same as the current spot price of the underlying asset. For example, a BTC futures contract with 5 days left to maturity might be trading at $60,100 but spot BTC might be trading at $60,000. If all else remains the same, then the $100 difference will eventually decay to zero as this futures contract expires.

Let’s consider a few examples to fully understand contango and backwardation. Assume the current spot price of BTC is $60,000 (this is the price at which an investor can trade BTC in the open market).

Scenario A:

BTC December 31, 2021 Futures Contract Price: $65,000. This is the price of the BTC futures contract which expires on December 31, 2021. In this case the difference between the spot and futures price of +$5,000 is referred to as the basis. When the basis is positive, traders refer to this as the market being in contango. This basis will eventually converge to zero as we get closer to the December 31, 2021 expiry date. In an efficient market, the basis should simply reflect the cost of carry and shouldn't provide too much insight on market sentiment. However, crypto is an inefficient market and it's still difficult for investors to gain exposure to leverage in a regulated manner. Given these unique circumstances, in crypto basis can be more heavily relied on to understand the market's overall sentiment.

Scenario B:

BTC December 31, 2021 Futures Contract Price: $57,000. Similar to the above case, this future will expire on December 31, 2021, however, the basis is now -$3,000. When the basis is negative we refer to this as backwardation. This is less common and occurs when markets are stressed and investors are bearish on the future price of an asset. Similar to above, generally when investors are bearish this causes the futures price to fall below spot, hence resulting in a negative basis. Recall it’s easier to understand the impact of the basis effect in crypto given the market is still growing (the basis in traditional markets wouldn’t provide as much insight into market sentiment).

At this point one might think — why would the price of the futures be different from the spot price? The primary reason is investors have directional views on the underlying asset and will use futures to make their bets. If a lot of investors are extremely bullish on BTC, then their collective buying pressure would bid up the futures contract price well above the current spot price resulting in a positive basis. Conversely, if investors have a negative outlook on BTC, then they’re likely to sell more of the futures contracts which could cause its price to be lower than spot resulting in a negative basis.

With this context we can now dive into modelling the BTC futures ETF.

Part 3: Modelling Hypothetical Futures ETF Performance

At this point we should understand that BITO and all the other BTC ETFs launched a few weeks ago are synthetic and not physically backed by real BTC. As a result, this will lead to differences in the return profile between holding real BTC vs holding a futures based ETF. In the BITO summary prospectus there’s a risk disclaimer warning investors of this very issue.

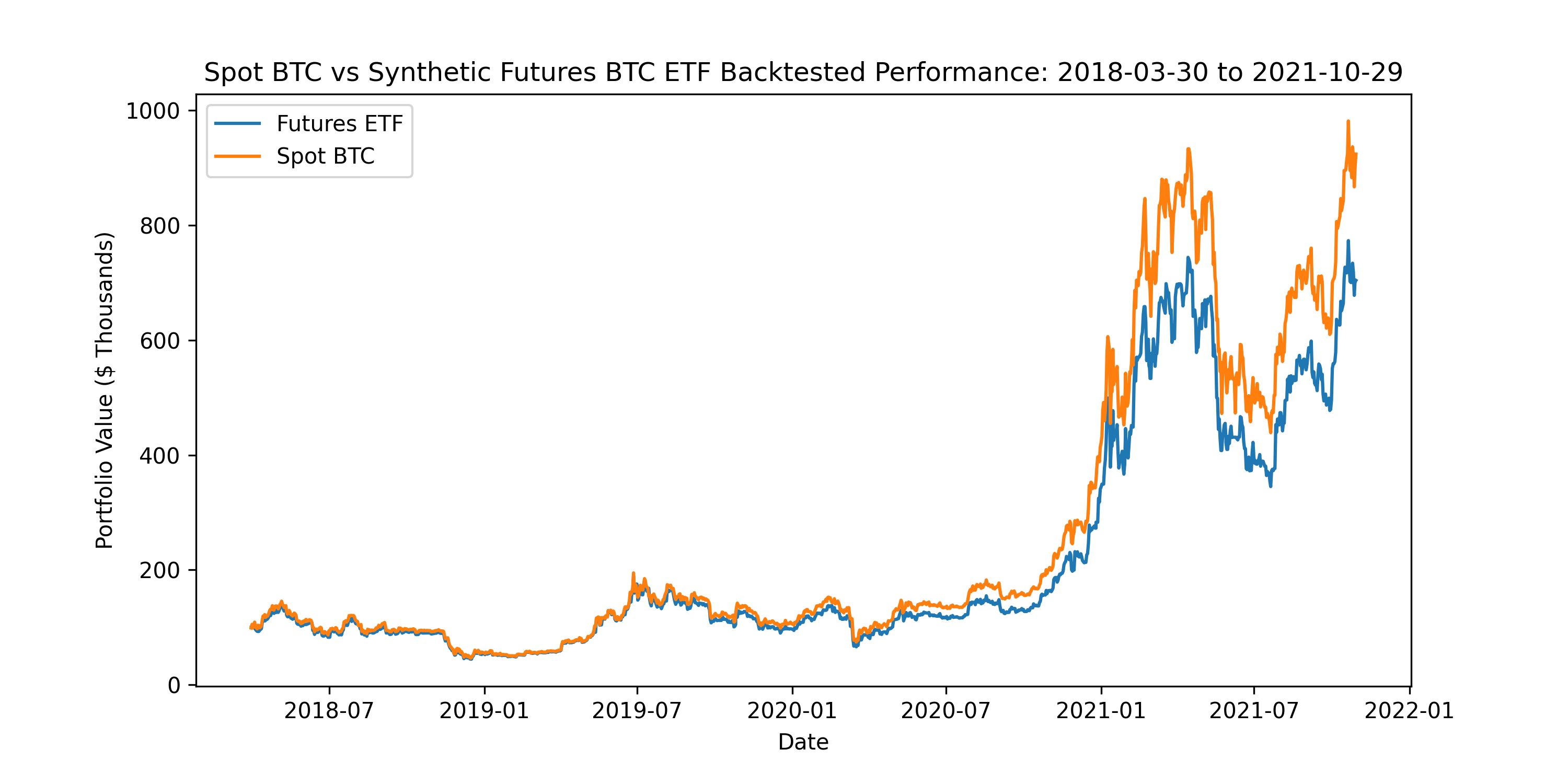

The entire purpose of building a quantitative model is to investigate the last sentence of the disclaimer — “these differences could be significant.” We will actually quantify the difference between holding spot BTC vs investing in a BTC futures ETF through a backtest as will be explained below:

Suppose an investor has $100,000 and is thinking about the following options:

- Buy $100,000 worth of real BTC at the current spot price

- Buy $100,000 worth of a futures-based ETF

A simple way to check which option is better would be to track how much the initial $100,000 grows over several years in either scenario. Unfortunately, all of these BTC futures-based ETFs were only launched several weeks ago, therefore, we do not have sufficient data to make a direct comparison over the long-run. However, BTC futures trading on the Chicago Mercantile Exchange (CME) has existed since early 2018, so we should be able to use this data to replicate the historical performance of a futures-based ETF across time.

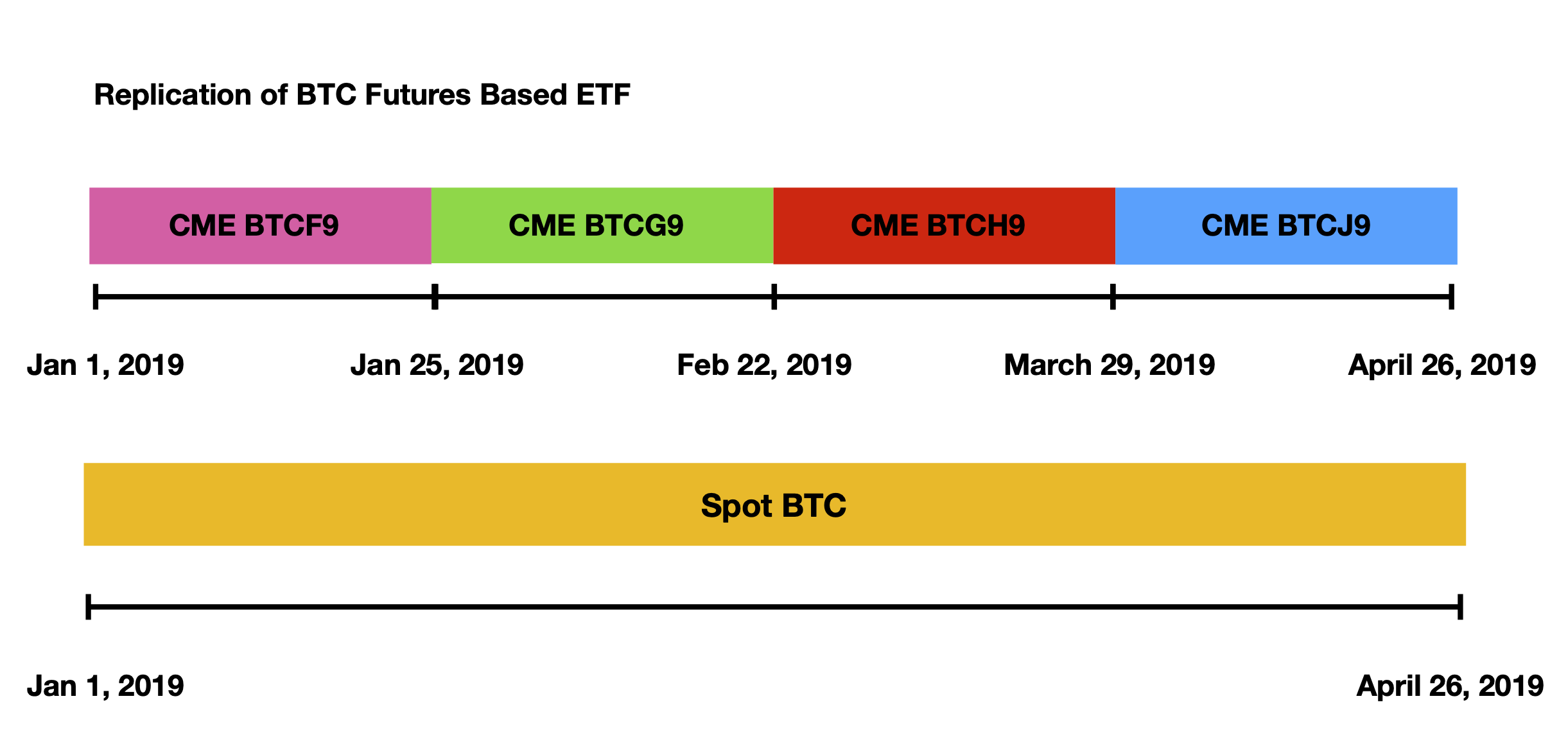

BITO and other related ETFs hold CME BTC futures with roughly 1-2 months to maturity. To keep things simple in our model we will buy the one month BTC futures contract, hold it to maturity, and then reinvest our capital into the next one month futures contract. This process of rolling into monthly futures contracts will be repeated for the duration of this analysis.

As each CME contract expires, we will roll into a new futures contract and repeat the process. The goal here is to compare the returns from rolling into futures relative to just holding spot BTC.

Over the course of nearly 4 years we can see the difference between the two options is quite apparent. At the end of the backtest, if the investor held onto spot BTC he would have a portfolio value nearly 30% greater compared to holding the futures ETF.

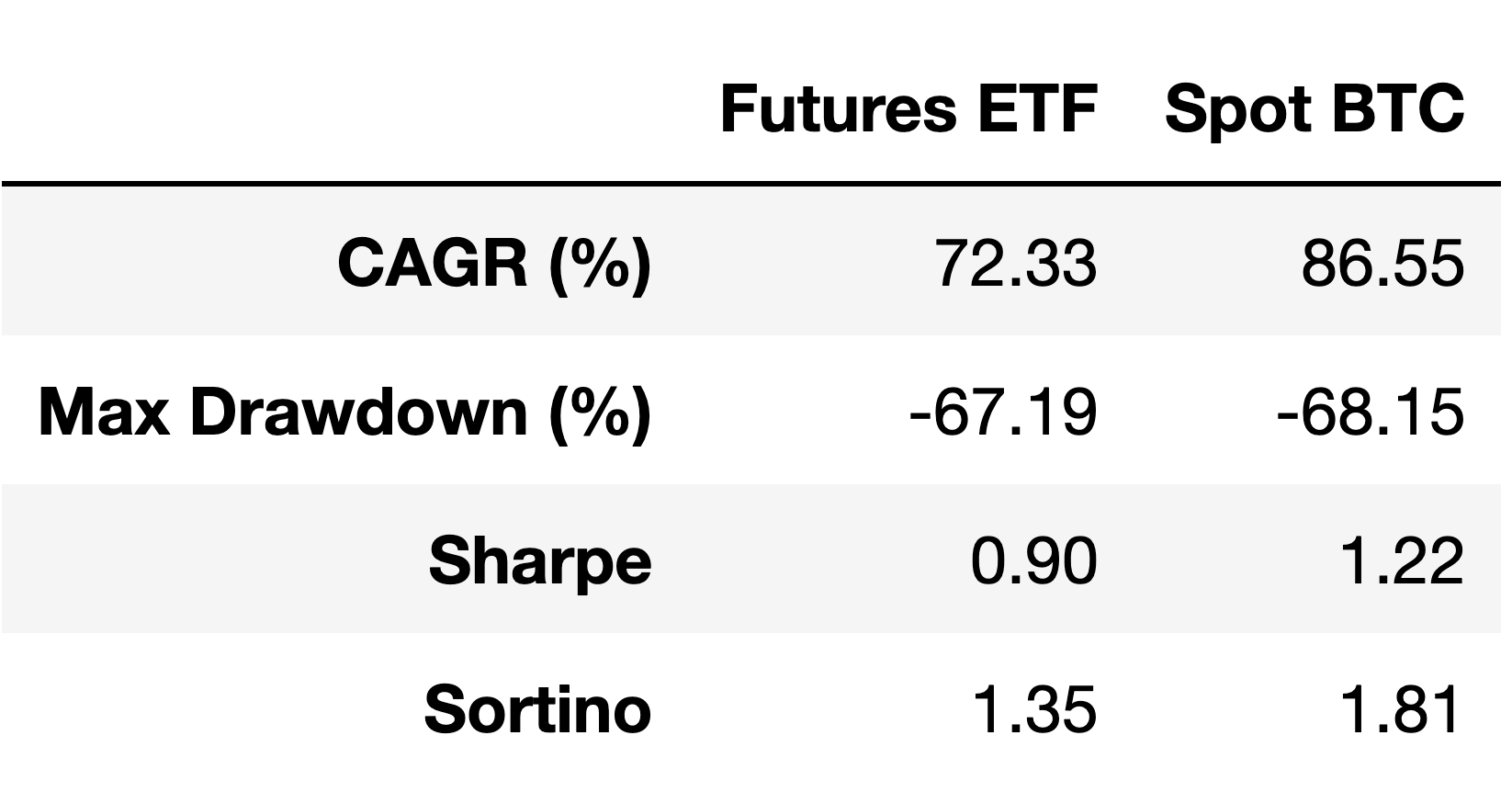

Furthermore, we can also run some investment statistics over this backtest period. Across nearly every metric, holding spot BTC is superior over the futures ETF.

What causes this behaviour and why does the futures ETF underperform by such a wide margin? This will be best explained with yet another example.

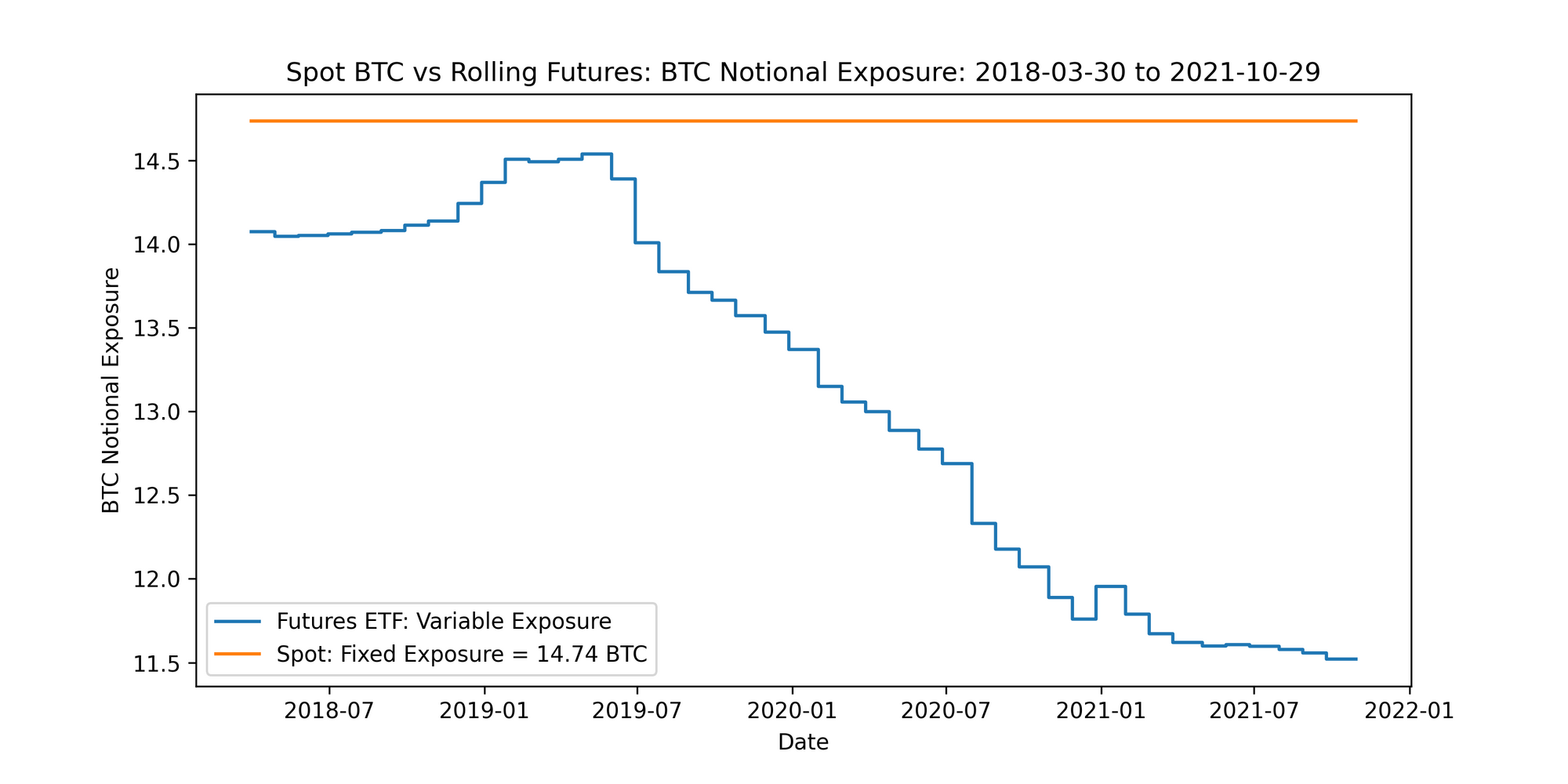

With the first option of buying spot BTC (at the start of the backtest on 2018-03-30) suppose the investor bought $100,000 worth of BTC at $6,785 giving him 14.74 BTC worth of exposure. This quantity remains fixed throughout the backtest — he will always be exposed to 14.74 units of BTC if he just buys and holds real BTC.

Under the second option, at inception the investor purchases $100,000 worth of CME BTCJ8 (ie: April) futures at a price of $7,105 giving him exposure to 14.08 BTC. He will hold this position until the futures contract expires on April 27, 2018. Upon expiration he will close this futures position by selling at the close price of $9,223 per contract resulting in a portfolio balance of roughly $130,000. From here the investor would allocate his entire balance of $130,000 into the CME BTCK8 future (ie: May futures) at the contract’s price of $9,241 giving him now exposure to nearly 14.05 BTC (ie: $130,000 / $9,241 ≈ 14.05 BTC). The investor will have to continue this same process on a monthly basis.

A few important points to highlight:

- With the first option of buying spot BTC, the investor’s exposure to BTC will always remain fixed at 14.74 BTC. Conversely, by rolling into CME futures the investor’s BTC exposure will constantly be changing every time a trade is made. This is largely explained by the fact that futures contracts have basis embedded into their prices. If there was no basis baked into the futures prices, then by definition trading the futures would be equivalent to trading spot.

- As discussed earlier, during periods of contango the futures prices will be greater than spot. On a relative basis, this will result in the investor receiving less BTC than if he had just bought spot BTC (ie: buying $100k worth of BTC at spot for $60k vs buying $100k of BTC futures at $65k — in this case the investor receives more BTC by purchasing at spot). Conversely, during periods of backwardation where futures prices are less than spot, the investor will accumulate more BTC than if he had just bought spot (ie: buy $100k of BTC at spot for $60k vs buy $100k of BTC futures at $55k — in this case the investor receives more with the futures).

- To recap, with the futures ETF the investor is able to increase his notional exposure to BTC during periods of backwardation because the futures price is below the spot price. In bull markets when the futures basis is in contango, the futures ETF will by design gradually lower its notional exposure to BTC.

- Below is a chart highlighting how the investor’s notional exposure to BTC under the futures approach changes over time. Given this backtest began in the midst of a bear market, the period up to July 2019 resulted in a growing BTC notional exposure due to the negative basis during this time. However, notice in late 2019 as the bull-market began, the BTC notional exposure gradually declined due to the positive basis from the futures term structure.

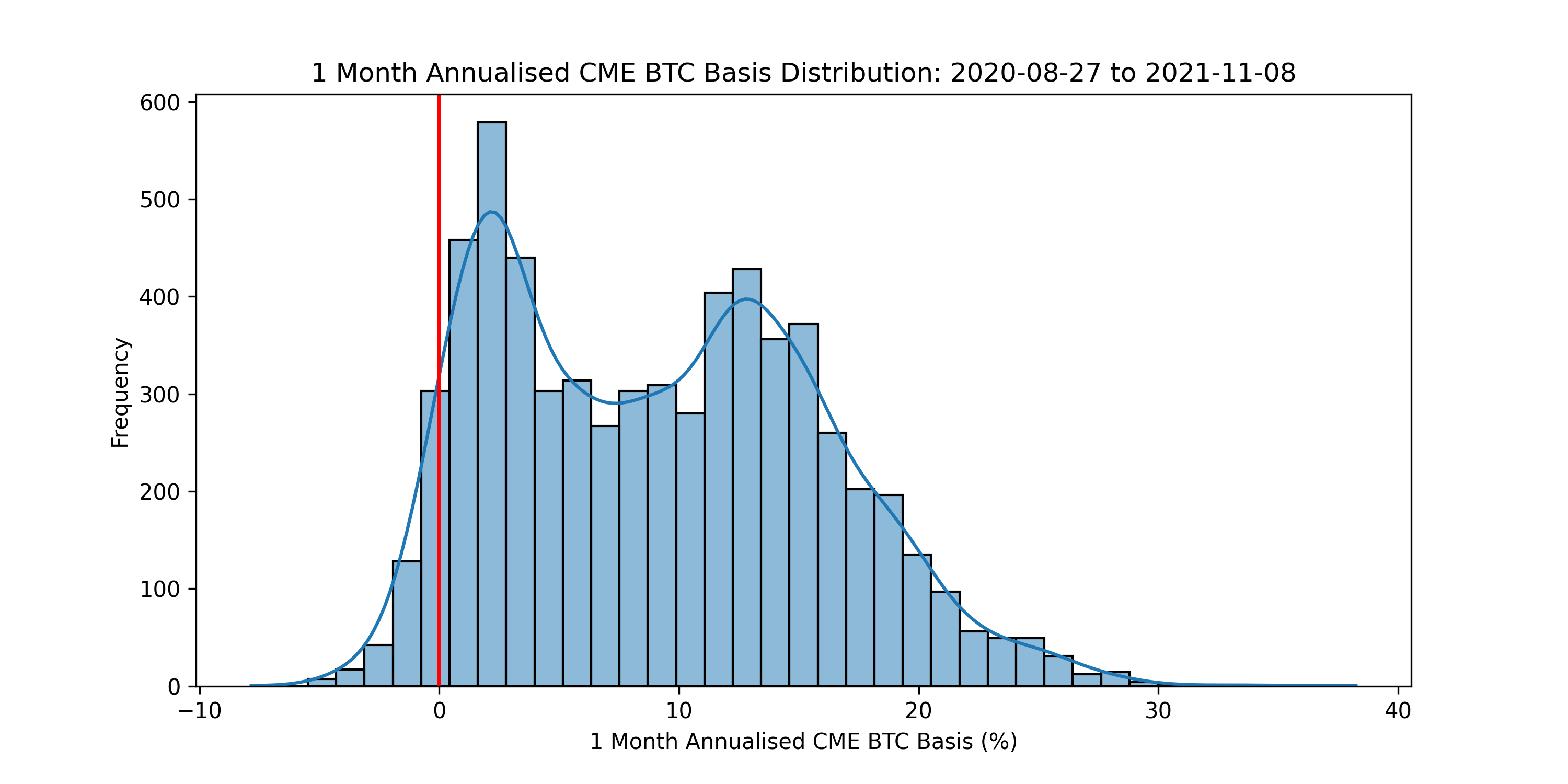

- As mentioned above, the only case where the futures ETF would be able to accumulate more BTC exposure is if the futures term structure is consistently in backwardation where the basis is negative, however, these periods tend to be quite rare. The histogram below showcases the 1 month annualized basis for BTC CME futures since August 2020 - notice how the basis is almost always greater than zero. This largely explains why the futures ETF would fail to keep up with spot BTC in the recent bull market.

Concluding Thoughts

While most of this analysis has been critical of the new BTC futures ETFs, there are some niche use-cases where this product may be useful. Given the futures-based BTC ETFs underperform in the long-run relative to spot, these products are likely best suited for active retail traders who don’t have access to futures markets but wish to make short-term directional bets. Furthermore, due to regulatory or fund mandate constraints, many investors are not able to participate in BTC futures trading. With the introduction of these ETFs regulated under the SEC, these investors have a new product for gaining exposure to BTC.

Personally, I find it surprising as to why US regulators haven’t approved a physical BTC ETF yet. As demonstrated in the modelling analysis, holding spot BTC through a physically based ETF would be much better for both retail and institutional investors over longer periods of time. Most of the hesitancy from the SEC is due to their concern on how the BTC would be securely stored and protected with custodians. Once further clarity and solutions are brought forth by the industry, I believe the SEC will have fewer reasons to not approve a physically backed ETF.

Overall, while it was interesting to witness the debut of the world’s first US regulated BTC ETFs, it’s difficult to see how these futures-based products can sustain their market share as physically backed ETFs come to the market. Until a viable physical ETF product is available, investors seeking to gain exposure to BTC are better off taking the time to learn more about hardware wallets and security. Ironically, this process will likely instil a greater appreciation for the core ethos of crypto and perhaps these investors won’t even end up investing in the physical ETF but rather choose to self-custody.

Acknowledgements: Shiliang Tang for explaining the mechanics of rolling futures in a systematic manner and providing valuable feedback throughout the modelling process. Bruce Jenkins for providing useful comments pertaining to the futures term structure and proof-reading this research piece. And lastly, Greg Magadini for providing helpful insights on the futures basis and sharing ideas on how to work with futures data.

Disclaimer: Nothing mentioned in this article constitutes as financial advice. Opinions expressed are solely my own and do not express the views or opinions of LedgerPrime.