A Quantitative Analysis of DeFi Option Vault Strategies

Motivation

It may sound strange but crypto investors aren’t much different from traditional finance investors. While both parties have varying degrees of risk tolerance, one key similarity between crypto and traditional investors is their insatiable thirst for yield. To achieve this goal, a traditional investor might buy high dividend paying stocks, purchase income-generating real estate, or even trade bespoke OTC yield-enhanced notes.

Similarly, many crypto investors achieve their yield objectives through a variety of strategies including lending on decentralized money-markets, staking a protocol’s native token, or collecting trading fees by depositing passive liquidity into an automated market-maker.

Over the past few months DeFi ecosystems across different blockchains have witnessed a massive surge in new projects focused on structured product vaults with the objective of offering users sustainable yield. In their current form, these structured product vaults are selling fully collateralized call and put options in exchange for the premium. Given the infancy of these products, we wanted to perform an in-depth quantitative analysis showcasing the expected performance of these vaults and some thoughts on the future of this space. This research note will be organized as follows:

- Part 1: Summary of DeFi Option Vault Ecosystem

- Part 2: Historical Backtested Performance of ETH Covered Call Vault

- Part 3: Historical Backtested Performance of SOL Covered Call Vault

- Part 4: Thoughts on the Future of DeFi Option Vaults

Part 1: Overview of DeFi Option Vault Ecosystem

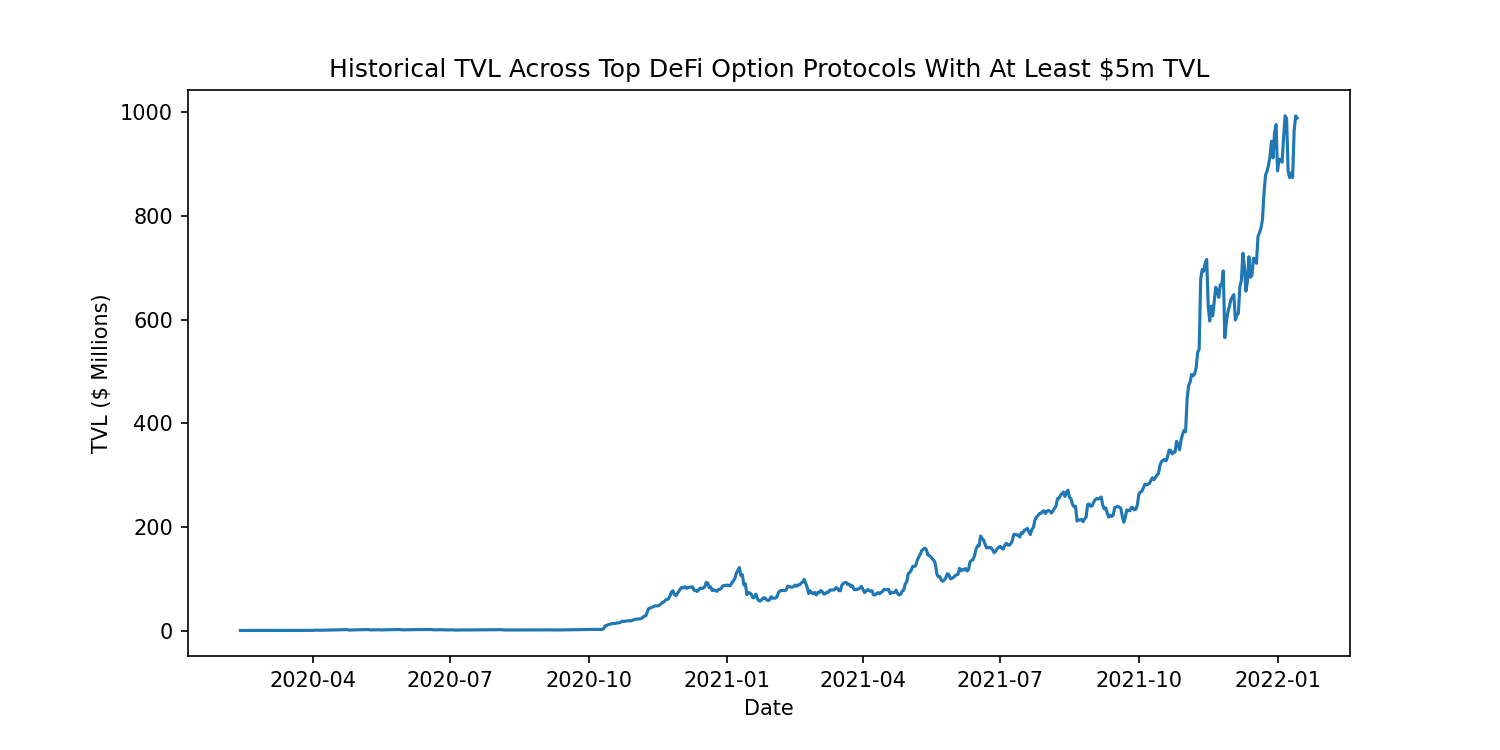

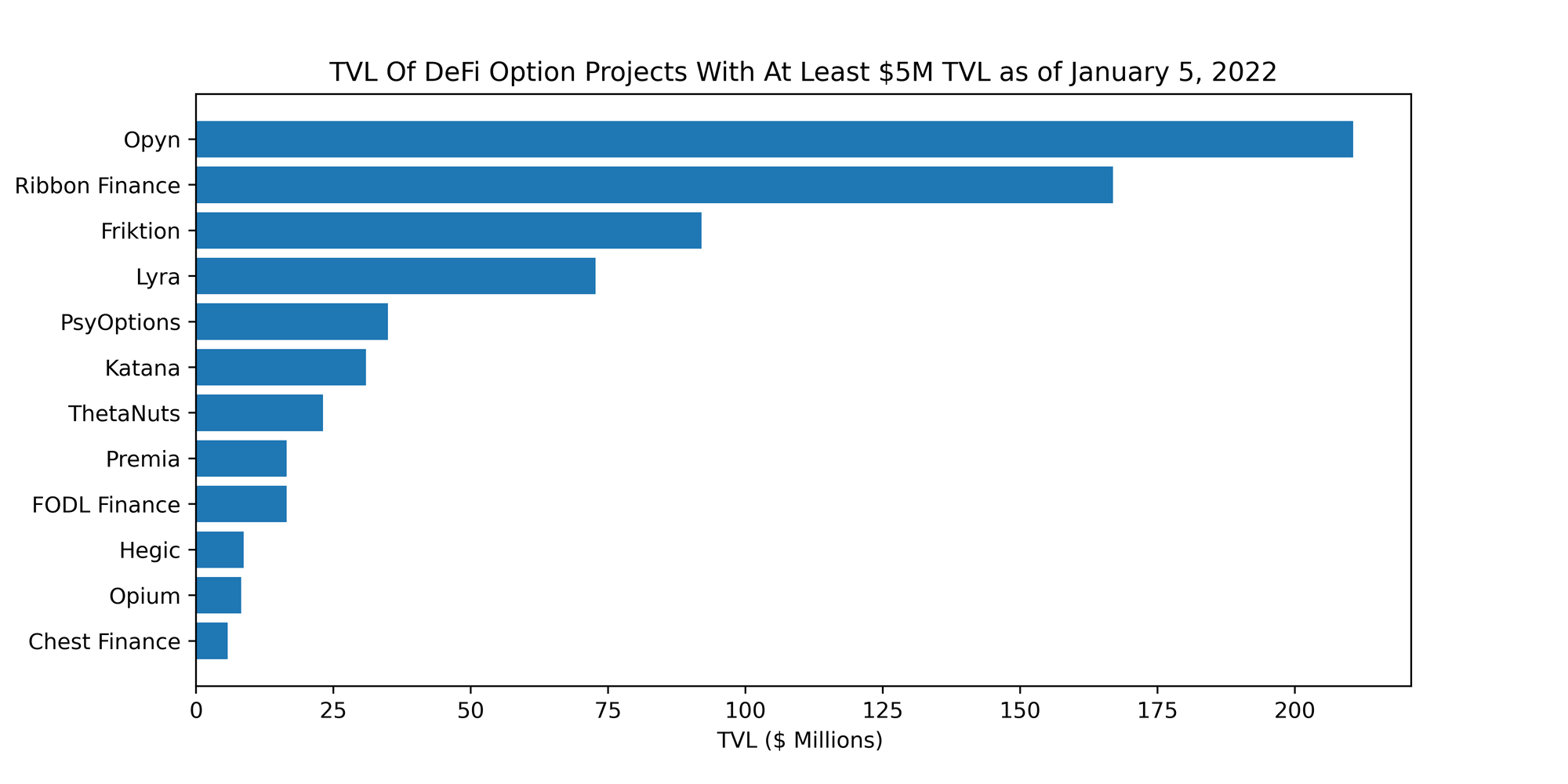

Since the beginning of 2021, the DeFi eco-system has witnessed an explosion in activity related to decentralized options and structured products. As shown below, the total value locked (TVL) across DeFi option protocols has gone from several million dollars in late 2020 to nearly $1B at the beginning of this year. This pace of growth is expected to continue as we see new option projects continue to build innovative solutions for users to earn yield.

Across all of these platforms, an overwhelming majority of the DeFi option vault strategies revolve around selling fully collateralized call options. This is a popular strategy used by both traditional and crypto investors seeking to earn additional yield on their idle assets. Let’s briefly review the mechanics of selling fully collateralized calls (ie: covered calls):

- An investor will own the underlying crypto and sell a call option with a strike at or above the current crypto price. In exchange for selling this option in the market, the investor will receive a premium.

- The act of selling a call option against spot holdings effectively caps the upside price exposure of the asset. Specifically, if the underlying asset were to skyrocket past the call option’s strike, the investor’s USD profit would be limited to: strike price - spot price + call option premium received. Below is a visual representation of how a covered call option is structured (PNL is in USD):

The risk of this strategy can be broken down into two components:

- Downside Risk: the investor is still exposed to the underlying crypto falling in price, however, this is partially reduced by the option premium collected.

- Upside Risk: if the price of the underlying crypto were to massively skyrocket in value, the investor’s USD PNL would remain capped. Therefore, the investor would have incurred an opportunity cost of making higher returns by just holding the underlying asset.

- From purely a yield perspective, the best case scenario is for the underlying asset to expire just below the call option’s strike price. In this case the call option will expire worthless and the investor will be able to keep 100% of the option premium initially sold.

With this context we can now move to modelling the historical performance of systematically selling covered calls on a variety of different cryptocurrencies.

Part 2: Historical Backtested Performance of ETH Covered Call Option Vault

ETH is one of the most popular assets on DeFi option platforms regardless of the underlying project’s blockchain. Let’s start by modelling out a backtest for systematically selling fully collateralized ETH calls and analyze the performance over time. The logic will be as follows:

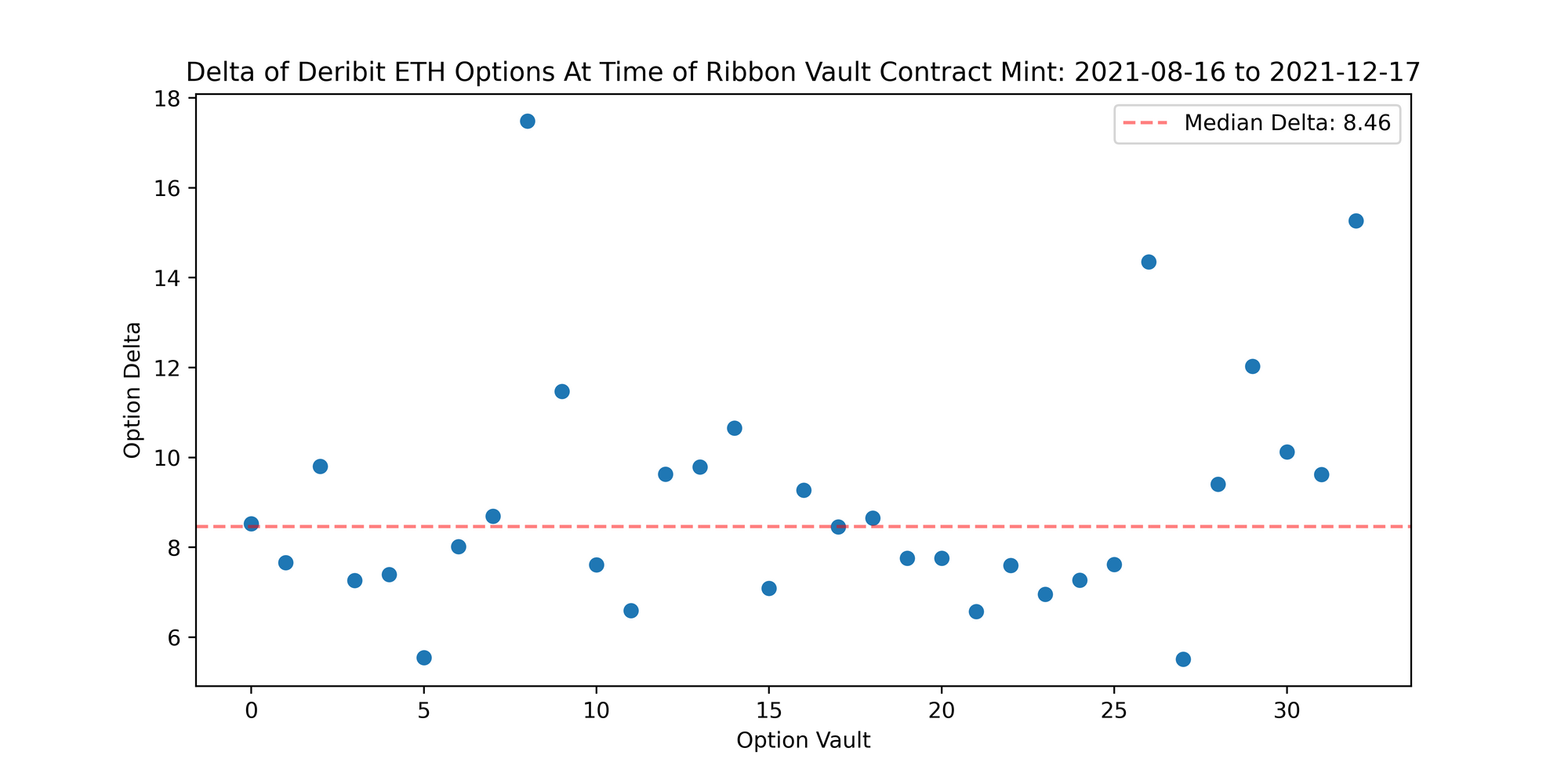

- Every week the model will look at historical Deribit data and sell 1 ETH call option closest to 10 delta. A majority of DeFi option protocols such as Friktion, ThetaNuts, Katana, Ribbon Finance, and Chest Finance generate yield for their users by systematically selling deep OTM call options around 10-15 delta. In the case of Ribbon Finance we can compare the protocol’s historical ETH trades to similar options on Deribit at the time of auction and use these respective deltas for comparison purposes.

- We’ll assume the option is sold at 90% of the top of the book bid ETH price based on historical Deribit data (a 10% discount was applied to account for the sensitivity associated with small orders disproportionately impacting top of the book prices). In practice option market-makers will likely bid lower than this given they have to make it worthwhile for warehousing the option risk on-chain without being able to benefit from any cross-margining on centralized exchanges.

- Similar to all the DeFi option vaults we’ll hold the options until maturity. At expiry there are two potential outcomes:

a) The call option will either expire OTM (strike < spot) in which the seller of the option keeps 100% of the option premium sold.

b) The call option will expire ITM (strike > spot) in which the seller will face an ETH loss of (spot - strike) / spot.

- It’s important to note the maximum gain in a covered call trade is the option premium received. Furthermore, the most an investor can lose in a single trade is his entire ETH collateral position.

- All of the options sold are fully collateralized based on the seller’s ETH equity. For example, at the beginning of the backtest we start with 1 ETH, therefore only 1 ETH call option would be sold. However, after several trades if the account equity is now 0.90 ETH, then the seller would short only 0.9x worth of ETH call options. This process allows us to compute the compounded returns of the strategy across the entire backtest.

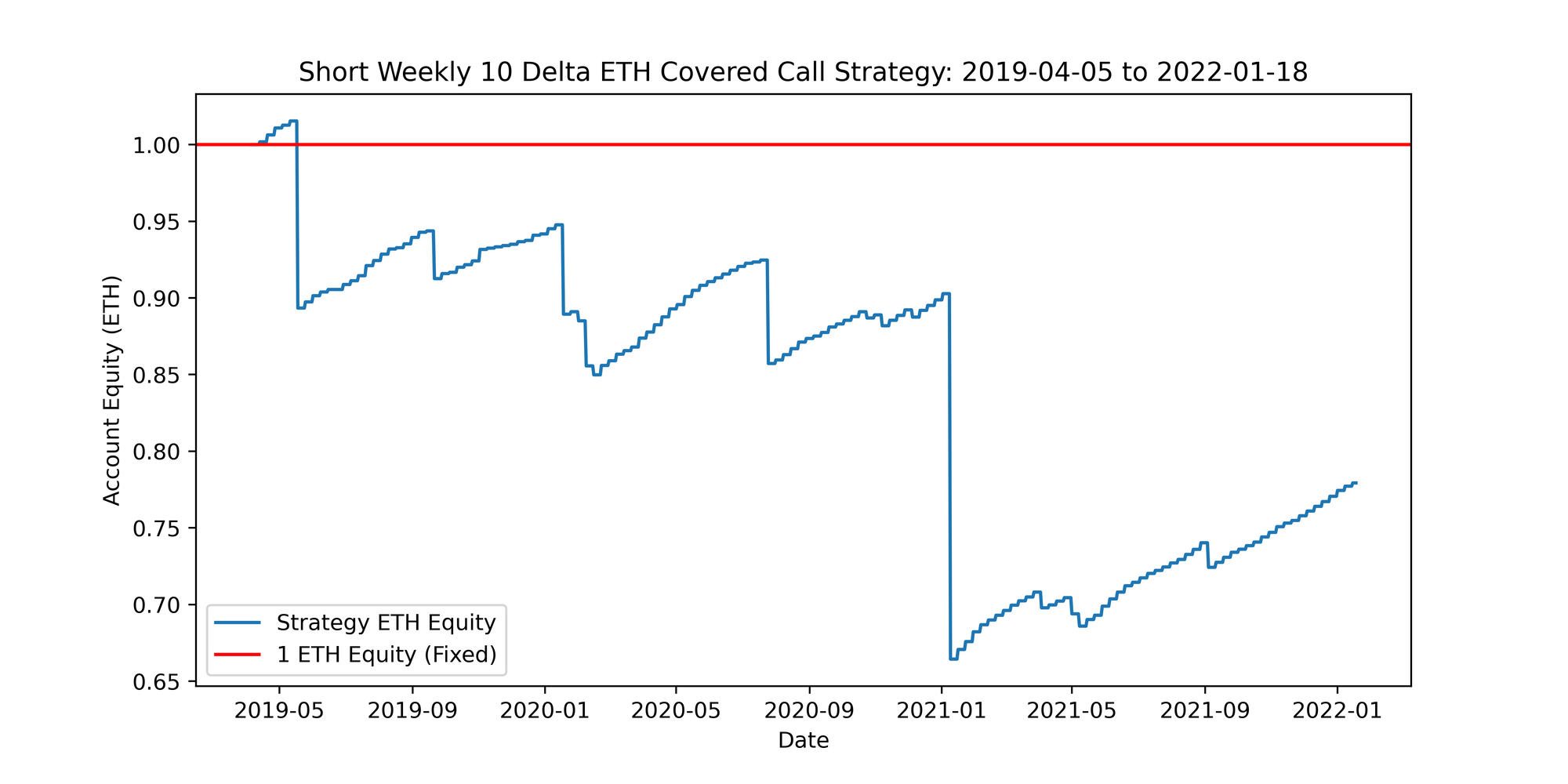

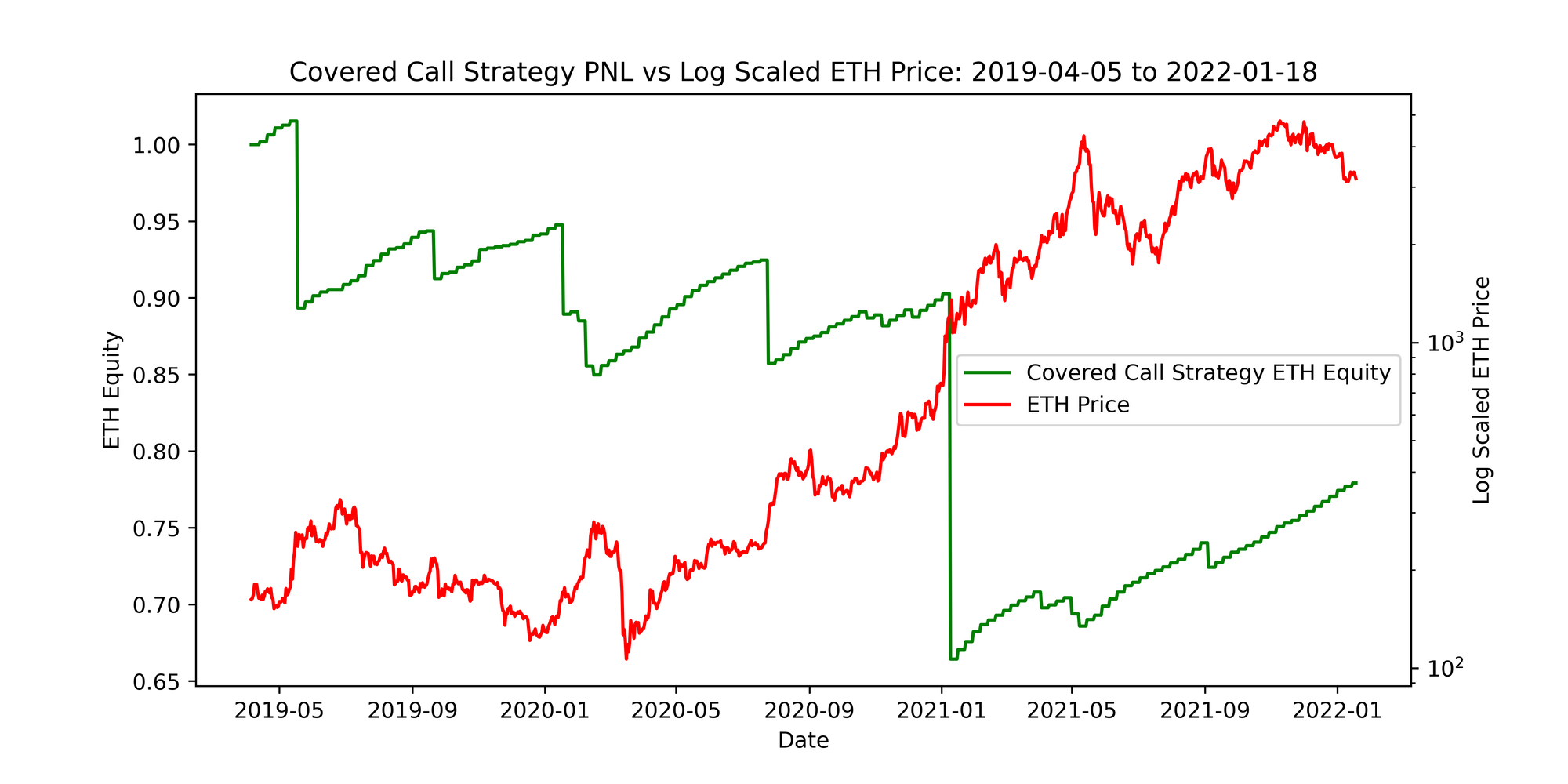

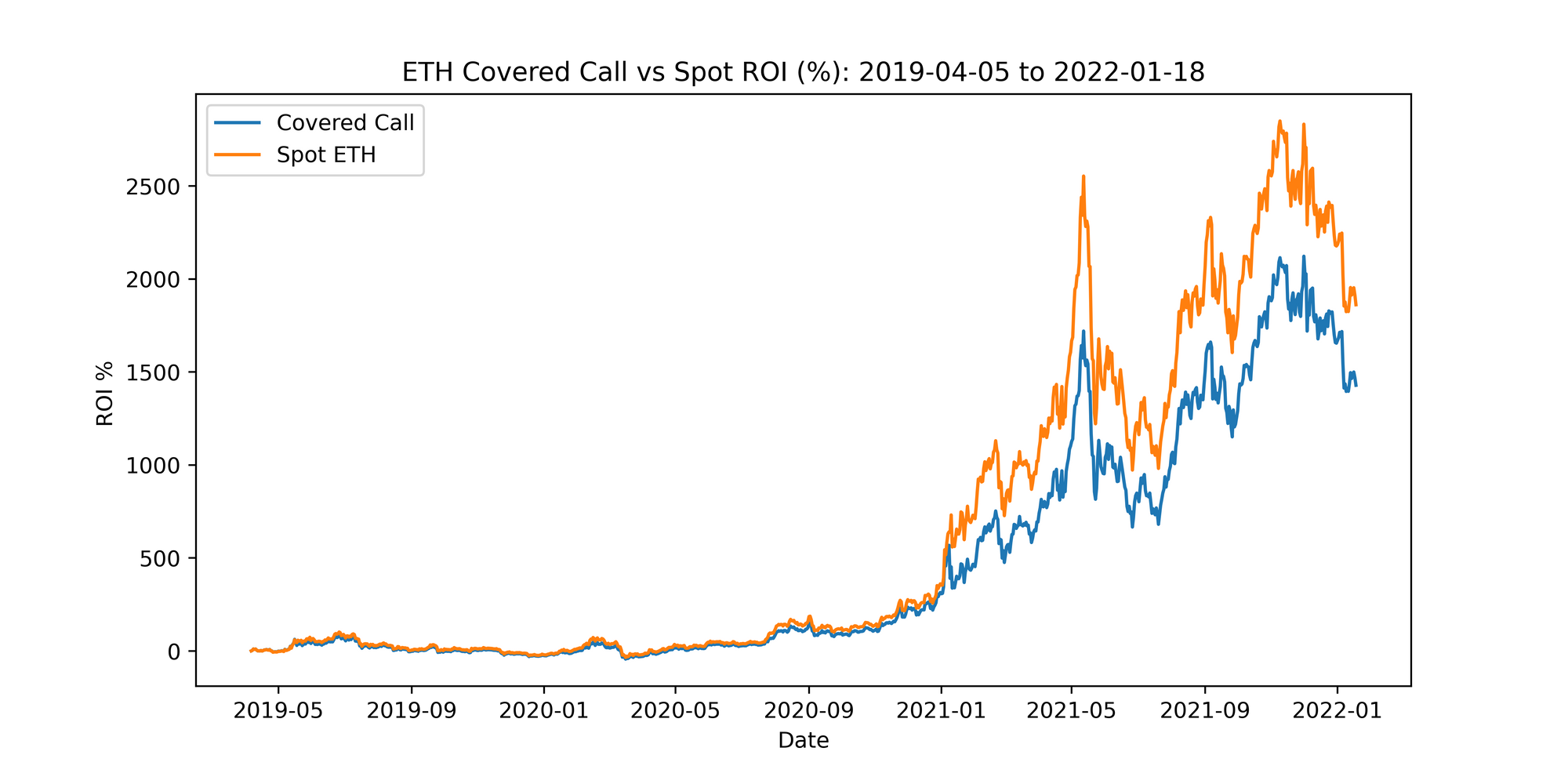

If an investor started with 1 ETH and systematically sold weekly 10 delta ETH call options with the methodology described above, he would have returned roughly -0.25 ETH over this time period. Recall covered call selling typically does well during choppy or bearish environments as the spot price has less of a chance of breaching the call strike. Therefore, these results are in line with what we’d expect given the past 2.5 years have been exceptionally strong for ETH.

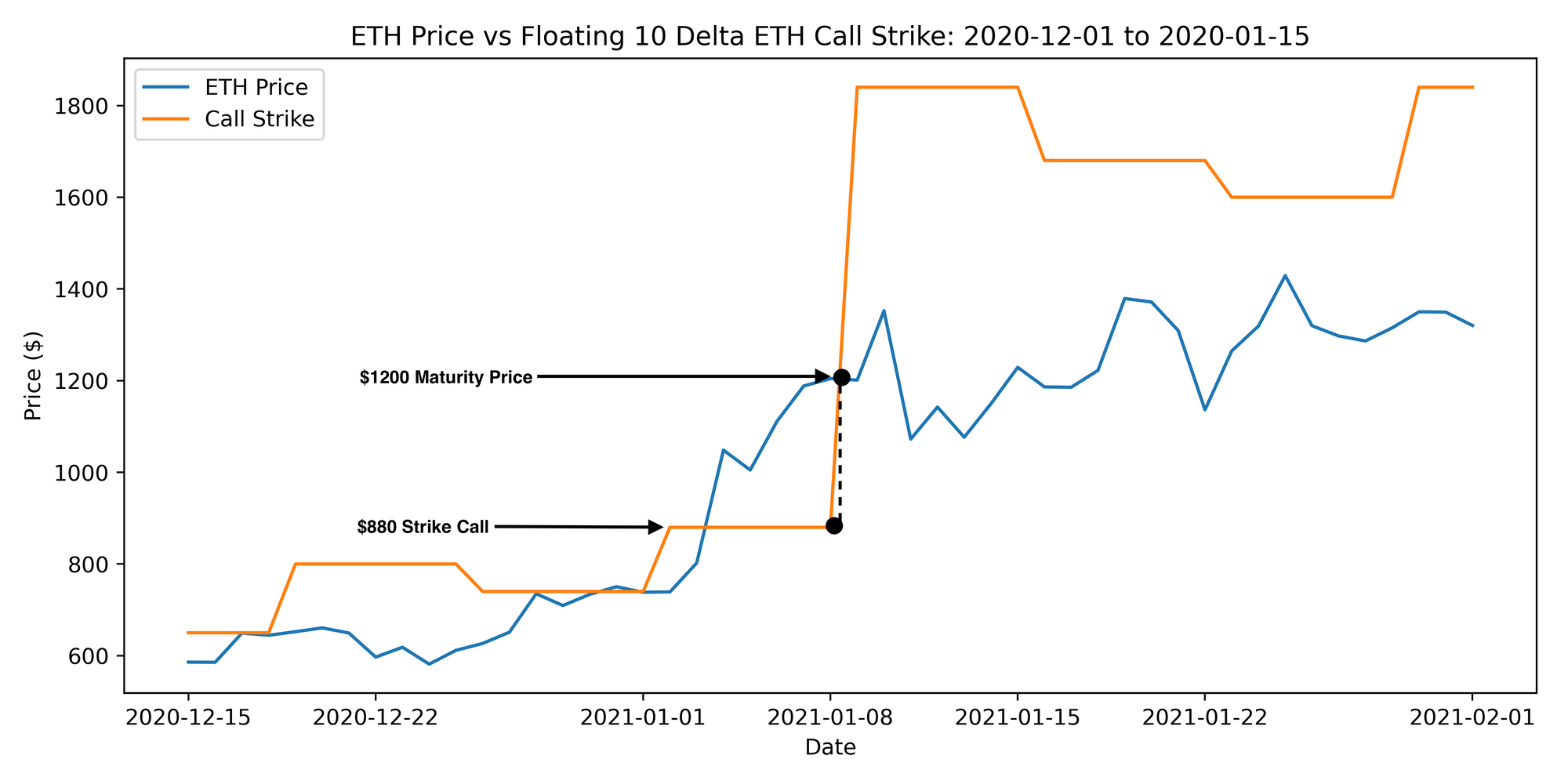

As can be seen above, this strategy faced a significant loss in early 2021. At that time, the model was short the $880 strike call option, however, ETH jumped from $740 to nearly $1200 within less than a week causing the option to be ITM by nearly $320 or 0.27 ETH. Although these major shocks tend to be infrequent, it only takes a single black-swan event like this to significantly erode the strategy’s profitability.

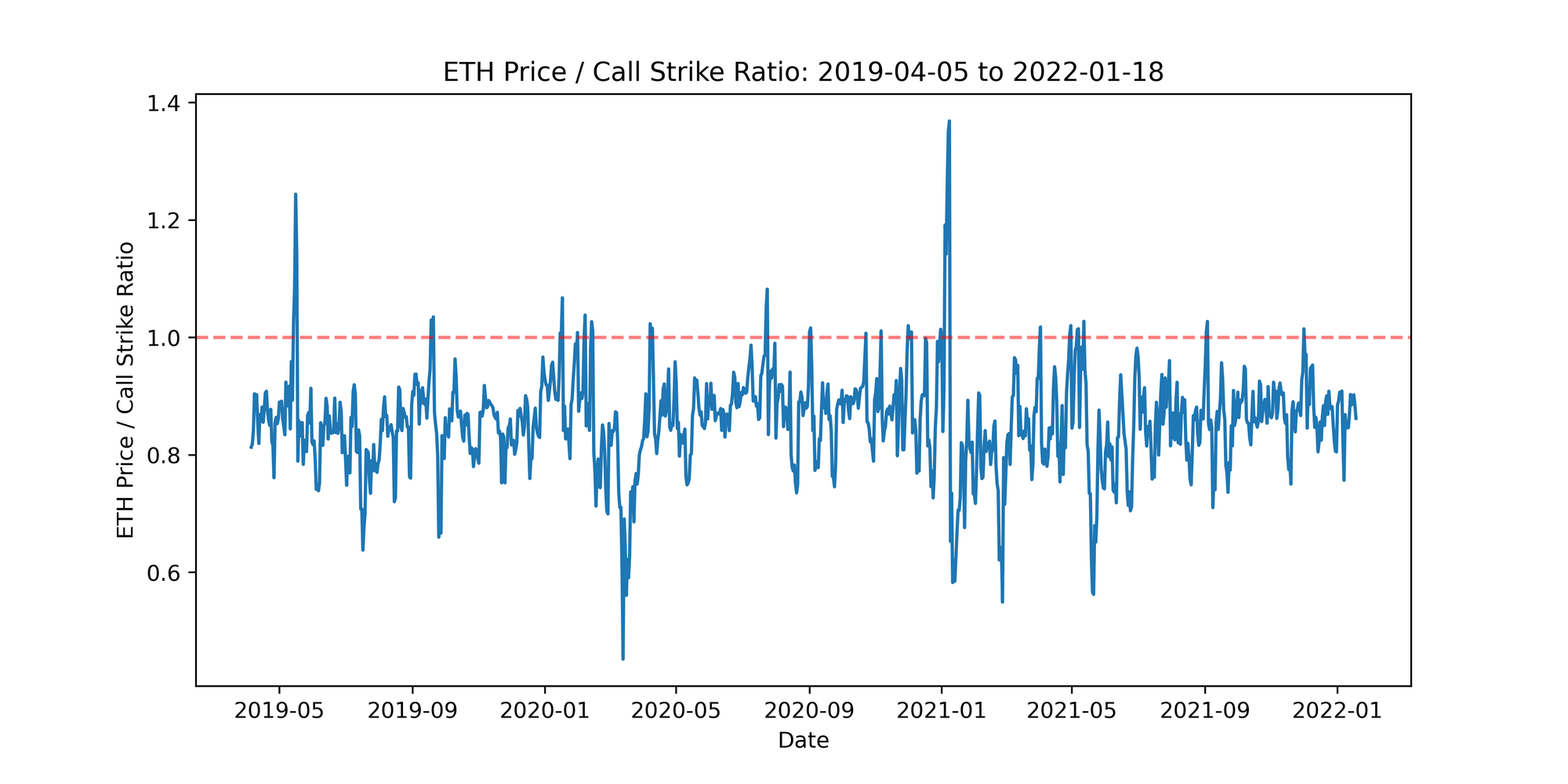

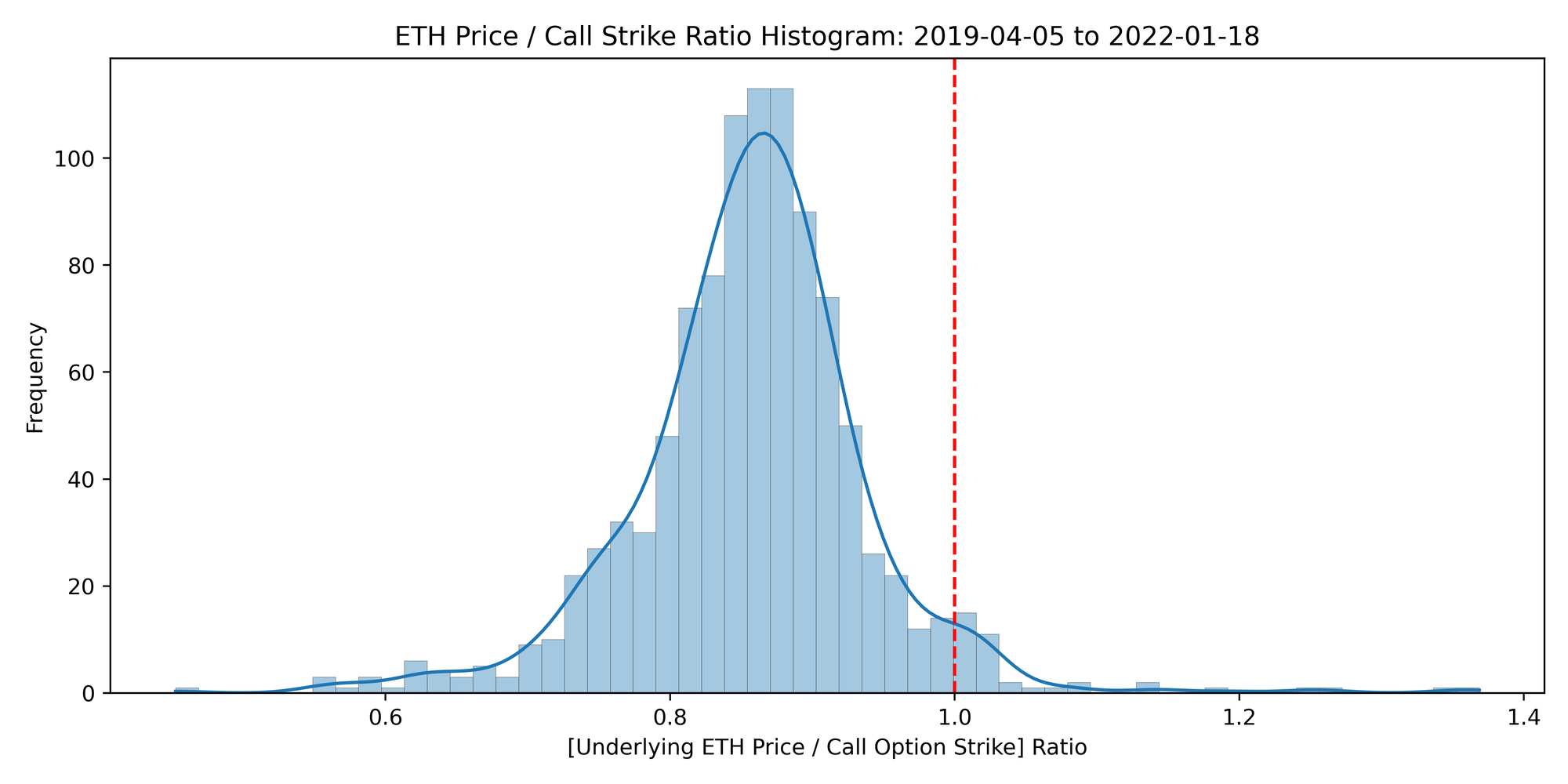

Another way to visualize the behaviour of these extreme events is to analyze the ETH price / option strike ratio. Whenever this ratio is greater than 1 it indicates the sold call option is ITM whereas less than 1 indicates the option is OTM. Based on the charts below it’s interesting to note that there aren’t many observations above 1, however, just a handful of exceptional tail-events are the primary root cause for the significant underperformance of this strategy.

When comparing from a USD denomination, the results are slightly better, however, holding spot ETH still massively outperforms the covered call strategy. Specifically, holding ETH would have returned 1860% whereas the covered call would have returned 1430%, resulting in relative underperformance of nearly 400%.

Overall, despite earning yield on their ETH, these results suggest that investors are better off just holding spot ETH rather than systematically selling deep OTM weekly call options.

Part 3: Historical Backtested Performance of SOL Covered Call Option Vault

Over the past several months LedgerPrime’s trading desk has seen considerable growth in terms of OTC altcoin options volume. In particular, Solana is one of the most popular underlyings for options outside of BTC and ETH, therefore, we’ll focus on modelling a vault strategy for this altcoin.

Currently there isn’t a reliable venue to retrieve historical SOL options data, therefore, we will have to bootstrap our own option prices. The approach will be as follows:

- Calculate the rolling 14 day close-close volatility for SOL using daily price data.

- Apply a 10 volatility point discount from the realized volatility and use this adjusted volatility to determine the strike of a 10 delta option (see appendix for technical explanation). With these parameters we can use Black-Scholes to calculate the price of the call option premium.

- We’ll use the same account equity calculations as discussed above with the ETH backtest (ie: user begins with 1 SOL and compounds his position for every trade). The model will hold onto the option until it expires.

- A key limitation of this approach is it fails to incorporate the volatility skew for a deep OTM option. Once a robust market for SOL options begins to trade, we can use the historical data from that venue and backtest this more accurately.

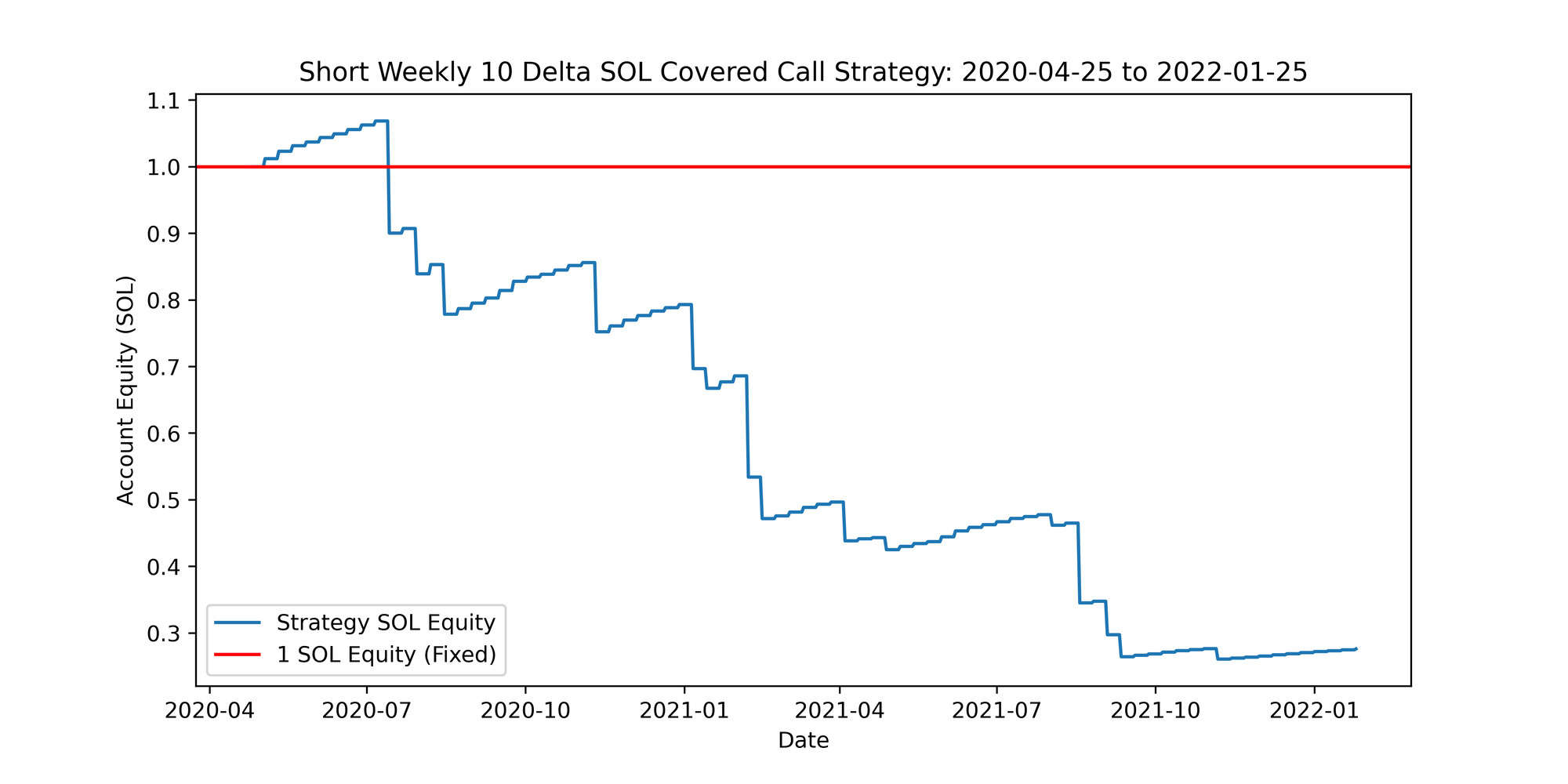

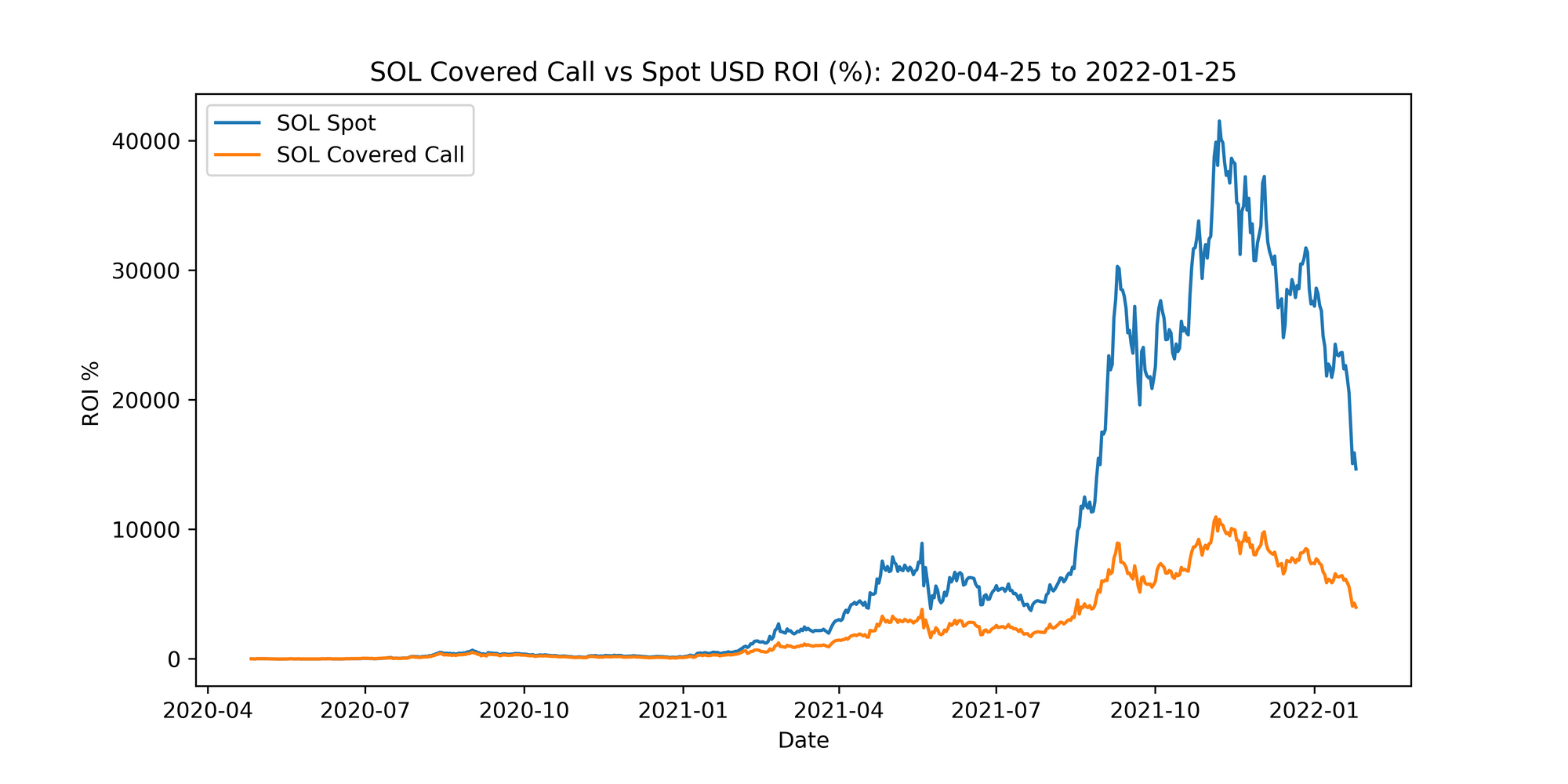

Unfortunately, the covered SOL strategy faced significant coin-denominated losses across the two year backtest period. A user starting with 1 SOL would only have roughly 0.30 SOL left from this strategy. Additionally, similar to before, while the USD returns for the strategy on their own are impressive (~4,000% ROI), it massively underperformed just holding spot SOL (~14,700% ROI). In other words, there’s an opportunity cost of nearly 10,000% for trading SOL covered calls rather than simply holding spot SOL!

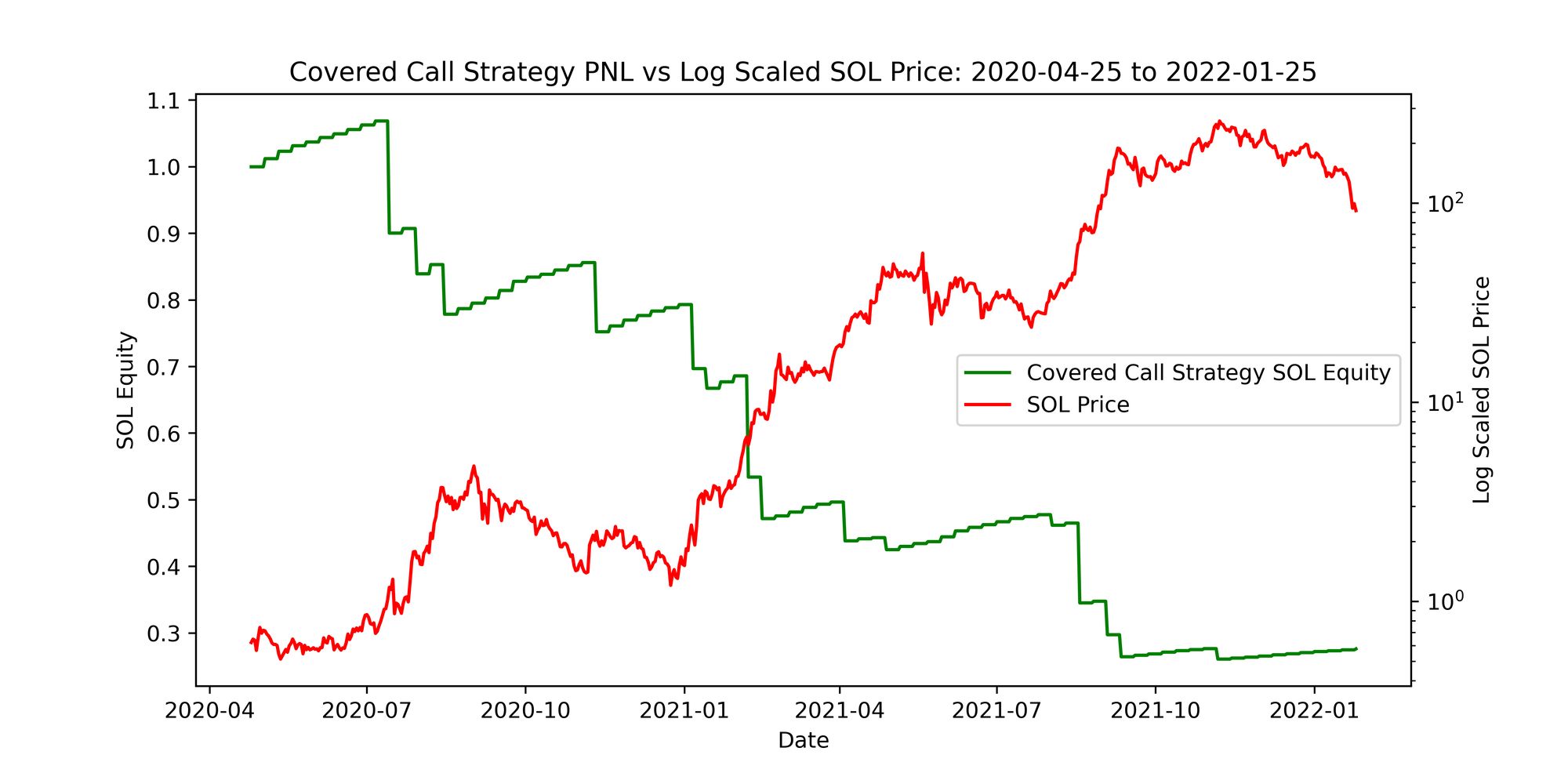

The massive underperformance is due to SOL’s exponential price rise over the past 2 years. As can be seen below, anytime there was a massive jump in SOL’s price, this was associated with a declining SOL equity balance, similar to what we saw with the ETH backtest.

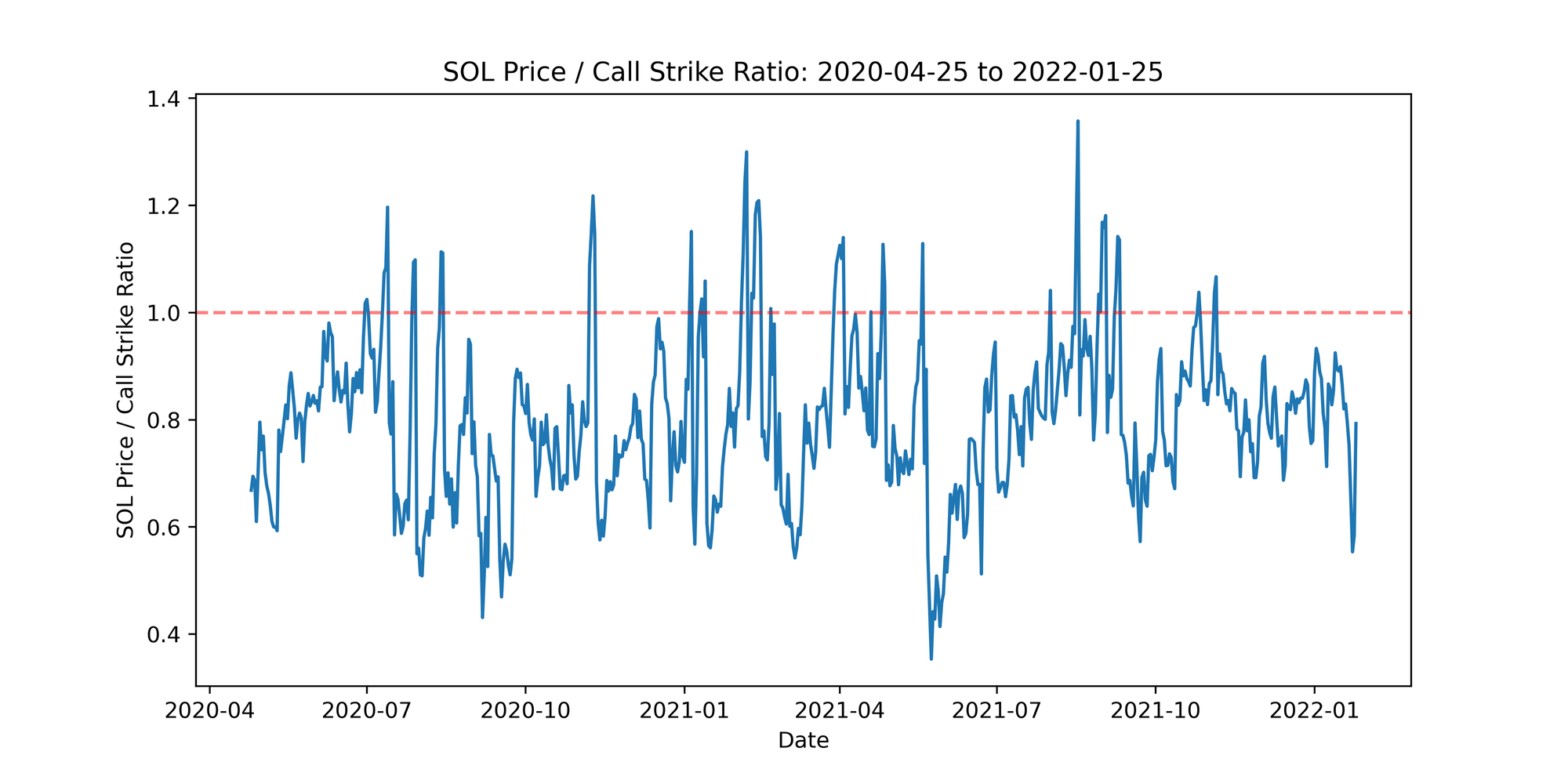

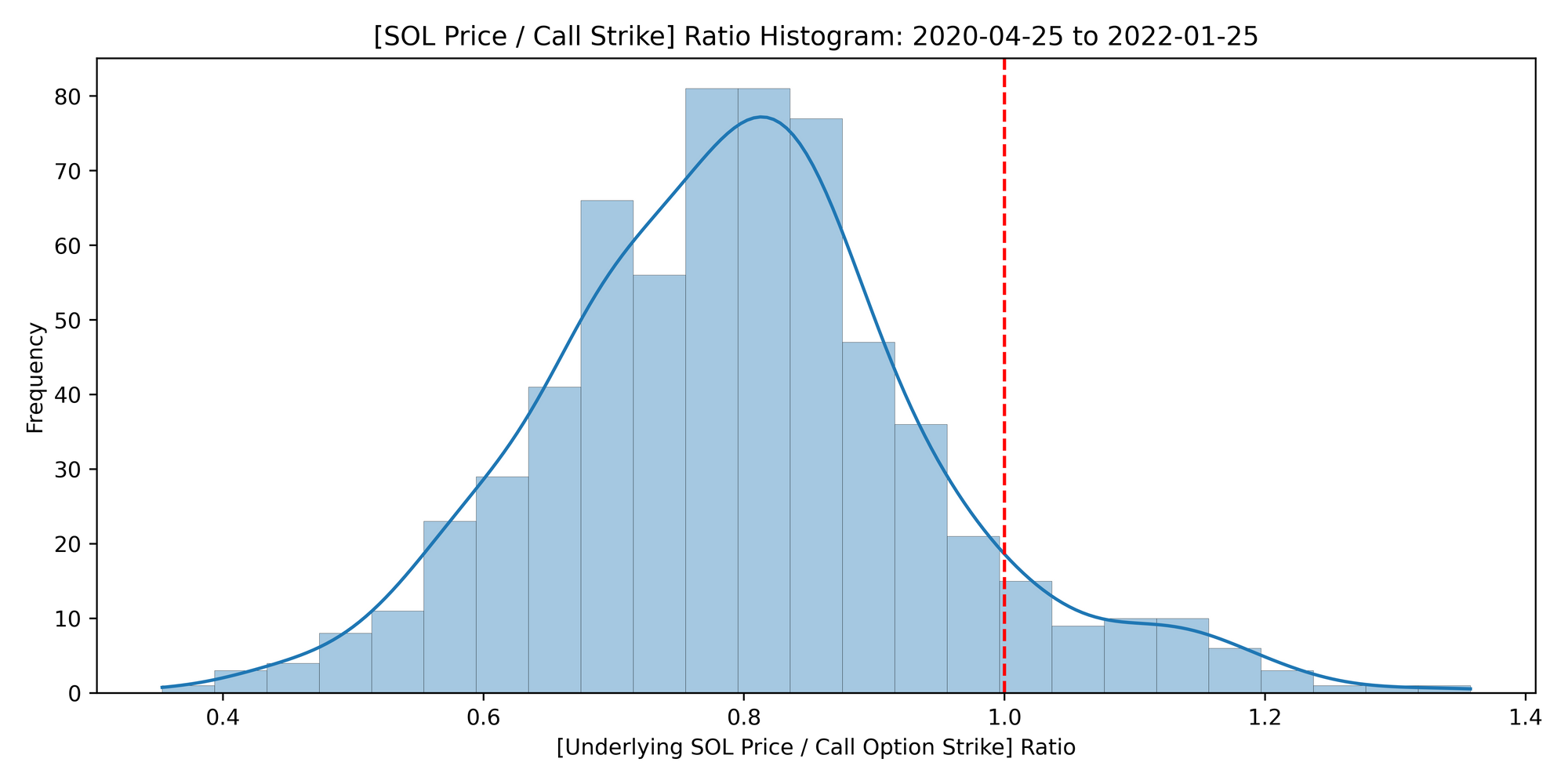

We can also look at the SOL price / strike ratio which is used to determine the magnitude of how deep ITM the SOL options can get. Relative to the ETH backtest, we can clearly see there’s more instances of the ratio being greater than 1. This indicates that the SOL call strike was breached more often and with a higher magnitude. Overall, from a purely absolute return standpoint it would have made sense just to hold spot SOL rather than systematically sell calls on a weekly basis.

Part 4: Final Thoughts and Conclusion

As shown with the ETH and SOL backtests from above, if an investor is extremely bullish on the short to medium term of an asset it would be wise for them to refrain from selling calls against their spot holdings. Covered call selling during bullish regimes may still generate a decent return in USD terms, however, it’s likely this strategy will significantly underperform relative to just holding the underlying asset. This is because during extreme bullish periods when a coin pumps there’s a higher probability the spot price will rise past the call strike and result in losses.

It’s crucial for investors to understand that selling option premium is not a guaranteed form of passive income. Similar to how liquidity providers on automated market-makers (AMMs) encounter impermanent loss during significant market volatility, investors selling options are exposed to a similar type of opportunity cost. Let’s review the comparison below:

- AMM: An investor will earn fees by depositing funds into a liquidity pool (LP). The LP position will be exposed to higher impermanent loss from pools with volatile pairs. In case of a massive price shock in either of the pool tokens, an investor will likely not earn enough from the liquidity provisioning fees to cover the impermanent loss, hence they’d be better off just holding the underlying asset.

- Covered Calls: An investor will collect premium by selling options against a fully collateralized position. In this case the investor is exposed to the price of the underlying asset jumping past the call strike, hence, resulting in coin-denominated losses. As an example, when looking at returns from a USD perspective, the ETH investor faced an opportunity cost of nearly 430% if he had just held onto spot ETH rather than selling covered calls.

While many of the insights from this research piece may be dismissive of selling calls for yield this is not the conclusion we want to convey. In many cases selling covered calls is an excellent strategy used by sophisticated investors and institutions. The key difference, however, is these parties don’t systematically sell the same weekly deep OTM covered calls, rather they analyze the market and have more discretion on which option type, strike, and maturity to trade.

With that being said, DeFi option vaults are still in their initial stages of development and there is still tremendous opportunity for these projects to allow for more flexibility on the underlying structured products. As a path forward, builders could create aggregators for these structured products which can allow strategists to mix-and-match option vaults across different platforms and craft tailored strategies which are more robust and sustainable in the long-run.

Overall, investors in crypto need a source of yield which does not depend on unsustainable token emissions and ideally is not correlated to general market moves. Option vaults are one of the few solutions offering users yield which is supported by professional market-makers and hence is more sustainable in the long-run. Lastly, DeFi option vaults will likely gain more adoption once projects launch vaults with more sophisticated strategies and allow for greater flexibility.

Acknowledgements: Ken Chan for explaining the mechanics of how weekly auction vaults work on Ribbon Finance and sharing his feedback on the historical backtest simulations.

Disclaimer: Nothing mentioned in this article constitutes as financial advice. LedgerPrime is an investor in Friktion and ThetaNuts. Opinions expressed are solely my own and do not express the views or opinions of LedgerPrime.

Appendix

Reverse-Engineer Option Strike Using Delta: The following formula below was adapted from Espen Haug’s book “The Complete Guide to Option Pricing Formulas.” Given we have to manually create hypothetical SOL options near 10 delta, this formula can help us determine the strike price which will allow us to calculate the option premium.